Supports

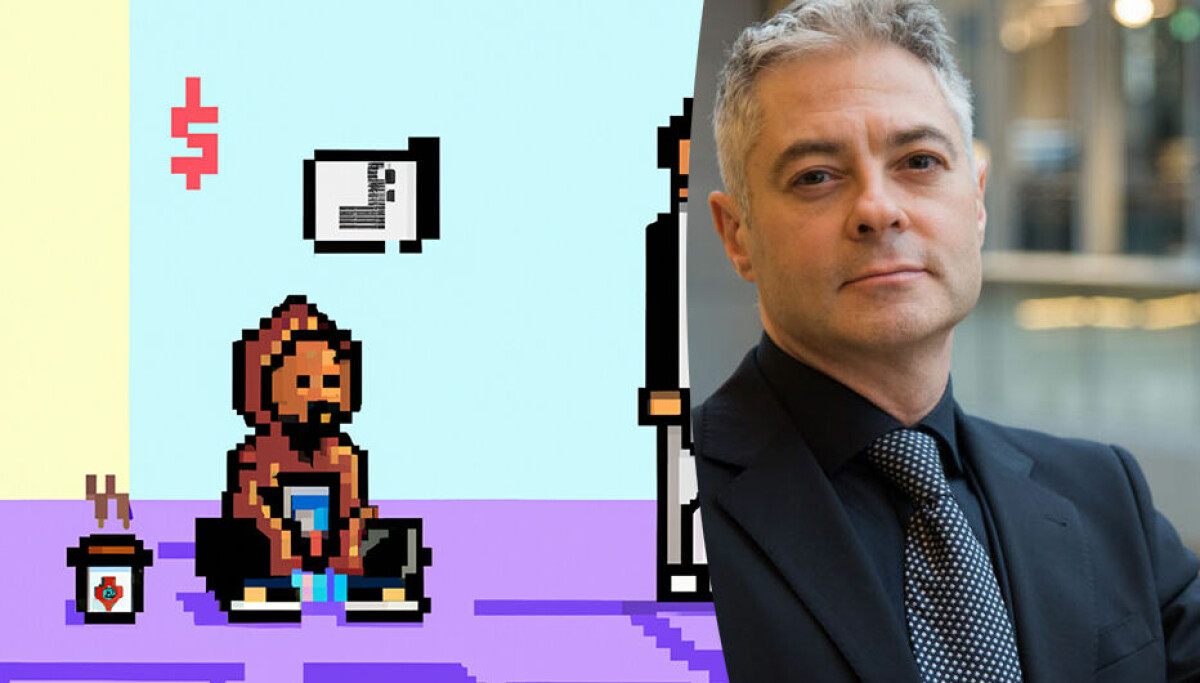

Drying up capital will dash many entrepreneurial dreams. Here are the signs that a startup is on its way to bankruptcy court, writes Salvador Bailly.

The global economy is suffering from a combination of high interest rates, inflation and an unpredictable economic landscape. Early-stage startups in particular are feeling the harsh effects of drying up on capital.

With the exception of some sectors such as artificial intelligence or green backed projects, the risk switch is in the “off” position. Entrepreneurs have to make do with less money, more expensive loans, and poorer and more skeptical potential customers. Therefore, it is more important than ever for both investors, managers, and owners to become aware of the decisions that could result in the entrepreneurial dream being bankrupt, sold at a lower price, or floating forever from the red numbers present in investors’ lives.

These are red flags that indicate bankruptcy is on the horizon.

1. The easiest way to determine the fate of a startup is to start a business based on the value proposition that exists only in the founders’ head. This is typical for entrepreneurs who have no experience or connections in the market or industry they wish to offer their services to. The vast majority of industries have gone through a long-term globalization process that has made them very complex. In addition, most value chains are owned by actors with established roles and employees who are sensitive to real changes, especially in the corporate market. Low customer willingness to pay is usually hidden behind a number of pilots that never generate significant income. However, there is an exception, which is if the startup started as a project for a larger client who has the necessary knowledge and contacts.

2. Related to the previous point is the question that most people avoid asking at first, which is, “Why has no one tried this before?” I’ve heard all kinds of answers when I’ve asked this question, from “because the players out there are too greedy” to “the industry is used to doing it this way.” Sometimes the answer is that “the technology was not mature.” Well, in this case, the technology is now ready for all other potential competitors as well. Again, there is an exception, namely if the leading company has some form of real competitive advantage.

3. The next red flag is the belief that the trends and conditions you face in your home country are the same as those in other countries into which you eventually intend to expand. This is especially true of legal frameworks and competitive situation. Most startups base their business on establishing their business in Norway first, followed by new countries later. Once they are ready for international expansion, many unfortunately find that local competitors have taken over other countries in the meantime.

4. All of these circumstances naturally lead to the need for capital to keep the company afloat being much greater than expected. The situation leads to conflicts between other major shareholders and the founders. These eventually leave the ship when they become unbearably diluted.

5. At this point the tragedy unfolds in earnest. The company’s largest investor appoints “professionals” who take over operations without sufficient experience in entrepreneurial activities. In other cases, they appoint new management that they “trust.” These people often come from another startup in which the investor has invested money, which has gone bankrupt or is barely managing.

6. Immediately afterward, new management hires consultants who have no real knowledge or experience of the industry and technology, or have little time to get it right, or listen to employees. The result will be a new strategy and restructuring of a company that can only run on Excel.

7. Those who remain with the original team watch the disaster unfold and lose hope and leave the company or are fired. This marks the final end of the entrepreneurial adventure.

We live in an era of abundant money and very cheap capital. This trend has reversed and harsh market forces will exert their force again. For entrepreneurs, investors and large corporations looking for acquisition opportunities, the world is becoming more difficult.

Therefore, it is more important than ever not to skip the analysis phase, but rather to do thorough preparatory work and take the time to develop a solid strategy.

Many people have greatly expanded the popular “burn the business plan” philosophy in recent years.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”