We are in a transitional period where central banks are incorrectly describing inflation. The narrative that is repeated over and over again is: “It’s fleeting, it’s fleeting, it’s fleeting.” It is not temporary.

The chief economist of the German banking and insurance giant, Mohamed El-Erian, is expelling central bank governors, especially the governor of the US central bank, according to what he reported. CNBC.

perfect storm

The last time witnessed a perfect storm of unfortunate events, accompanied by the ongoing Corona crisis It creates great waves for the global economy, Express freight rates and air freight rates.

In Germany, inflation rose to its highest level in 28 years, and it has not been the highest in the eurozone since 2008 – during the financial crisis. It is even worse in the United States, where levels have not been recorded in 30 years.

Despite this, the US Federal Reserve has repeated this many times High inflation is “temporary”, Something that is becoming increasingly controversial and controversial.

El-Erian believes that the central bank is losing credibility, and that they must ensure that they once again become a credible voice when it comes to inflation.

El-Erian points out that low-income earners are the most affected by rising prices, and the central bank’s view of inflation weakens their message and puts sticks in the wheel of President Joe Biden’s economic agenda.

We have plenty of evidence that behavioral changes are underway. Companies are charging higher prices and there is more to come. Problems in the supply chain persist for much longer than some expected. Consumers speed up their purchases to avoid problems – and this, of course, puts pressure on inflation. Then the wage behavior changes, says El-Erian, and concludes:

If you look at the basic behavioral changes, you will come to the conclusion that this will continue for a while. And that’s before we talk about the new Covid disruptions.

Historical Price Bang Alerts

– “upper” monetary policy

Al-Arian is by no means the only one raising the alarm. Christian Swing, chief executive of Deutsche Bank, urges central banks to tighten monetary policy.

According to him, central banks have a “too loose” monetary policy, which has significant risks and side effects.

“Inflation is rising around the world faster than any economist would have predicted a year ago,” says Swing. financial times.

Last year, debts owed to governments, businesses and households increased by $27 trillion to $226 trillion. In NOK, it would be 1795 trillion NOK. or to print it as a number:

1795.00,000,000.

The seamstress believes that central banks should take action, and fast, because if they don’t, problems will be much more difficult to solve.

The so-called miracle cure of recent years – low interest rates with apparently stable prices – has lost its effect, and we are now struggling with side effects. Monetary policy must confront this — sooner rather than later, he warns.

The side of the stock exchange according to the interest rate decision

Forecast “RAR”

Here in Norway as well, there are voices opposing the central bank’s view on inflation.

Nordea chief economist Kjetil Olsen says they are revising the projected interest rate forecast to 2 percent, up from 1.75 percent, which is 0.5 percentage points above the market.

This is justified by the high prices of imported goods, which in turn are driven by high prices for freight and raw materials “which have not yet fully reached consumers.”

“When it comes to imported inflation, we think their expectations are too low,” they wrote. financial forecast, Posted Monday.

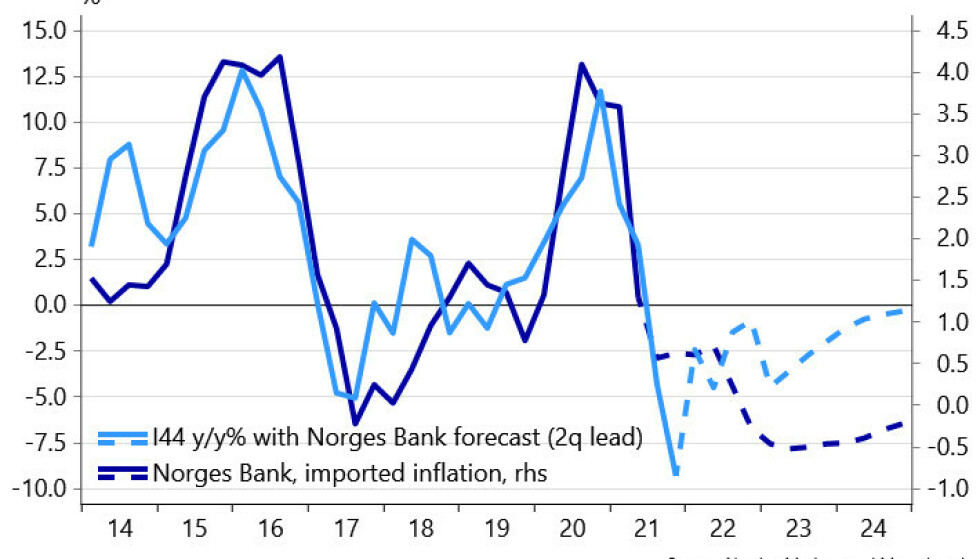

The development of the krone exchange rate is important for inflation in imported goods. Usually, they follow each other closely when we look at annual changes, Olsen explains to Bursen.

In Nordea’s economic forecast, they indicated that the Norwegian krone has strengthened, but Norges Bank does not believe that the krone will continue this development.

In the chart below, you can see how the import price and the krone exchange rate usually follow each other, the krone exchange rate usually follows the import price with a slight delay.

Hence it is this association that Norges Bank has moved away from. They believe that the krone will remain at about the same level, while import prices will fall every year until 2024.

reduce inflation

“This is completely against history and in and of itself should result in import prices adjusting by at least one percentage point,” said Nordea’s ruling.

– We think it’s strange that they go to the krone exchange rate. There is a clear risk that they are underestimating inflation in 2022. It’s a good estimate, Olsen says.

So the increase in the declared prices has not yet reached the Norwegian consumers.

We will likely see the first part during the new year. There are many who agree on shipping rates half a year and a year at a time, so we’ll likely see the increase. We do not know the exact size of the effect. We think the entire Norges Bank model, when we get to the end of 2022 and the beginning of 2023, is pretty low. Olsen says there is a clear risk that freight and raw material prices will go up, and consumers will have to pay more, a little faster.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”