On Thursday, the Oslo Stock Exchange closed down 2.3 percent. June ended on the Oslo Stock Exchange with an overall drop of about 8 per cent. This is the worst single month on the Oslo Stock Exchange since March 2020.

The exchange did not receive any help from the price of oil, which fell at 4 pm on Thursday by about 5 percent.

There is also a broad decline in Europe. Frankfurt’s DAX index fell 2.5 percent at 4 pm on Thursday.

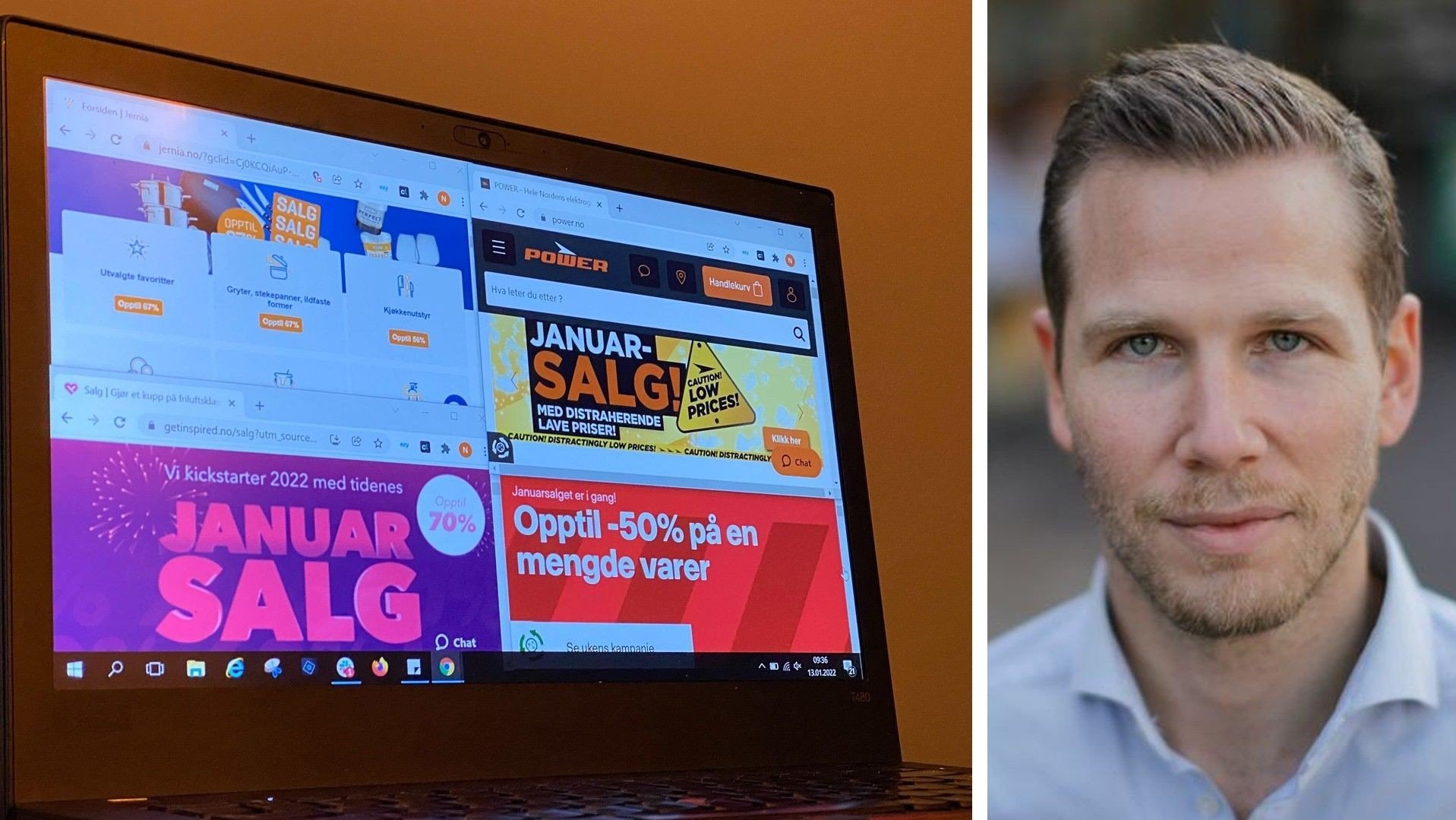

As European stock exchanges blow, Anders Johansen chief strategist at Danske Bank ventures out with a kayak in the calm, two-degree waters of Larkollen air outside of Moss. He doesn’t think we’ve seen the stock market bottom this time.

I don’t think so, to be completely honest. The fact that earnings estimates will drop a bit, at the same time that the risk of a recession in Europe or the United States, or both, is very strong, will weigh on the market during the fall, he says.

But the chief strategist sees places in the financial markets that it would be good to be in.

– Beautiful levels

The best advice he gives investors is to stay still in the boat, history suggests that on average you do better by sitting still rather than trying to time the market.

The second thing we see now is that both short fixed rate money market funds and bond investments have significantly higher expected returns over the next 12 months. More than four percent, according to Norwegian bond fund managers. I’m starting to get very good levels. Other than that, it’s the high-quality stocks that usually do well when there are tough times, he says.

Johansen’s favorite sectors during the day are health and supply, which in English is called “utilities”. Usually these are defensive sectors that should work well in theory when the world is uncertain and markets are shaking because they provide the goods and services that people need anyway.

On the Oslo Stock Exchange, lower oil prices dragged the main index down on Thursday. The monthly contract for a barrel of burnt North Sea oil, a reference price for oil trading worldwide, is trading Thursday morning at just over $115 a barrel, according to Bloomberg.

According to Johansen of Danske Bank, high inflation and stagnation uncertainty remain characterizing the markets. On top of this comes the uncertainty surrounding energy prices. He notes that the prices of important industrial commodities such as copper and steel have fallen recently, but oil and gas prices have remained high. This has helped increase inflation.

The US Federal Reserve now faces a difficult task. You should try to beat high inflation without pushing all of the economic activity into the trench.

– If you hit a global recession, at least it hasn’t happened before without the price of oil dropping sharply. If there is a global recession and the world’s demand drops suddenly, and thus the price of oil, the Oslo Stock Exchange will be at risk when it has performed well so far. For very local conditions, this is probably the biggest uncertainty that exists, says the chief strategist.

Pulling down heavy weights

Heavyweights include oil, gas and power company Equinor about 2.5 percent, oil and gas company Aker BP about 5 percent, aluminum producer Hydro about 9.5 percent, and fertilizer producer Yara about 6.2 percent.

Robot storage company Autostore continues to fall on the stock exchange. The stock fell about 13.6 percent on Thursday. In total, the stake has more than halved from its stock exchange listing in October last year, and the market capitalization has fallen to around NOK 51 billion.

Shares of oil company Petrolia rose about 33.5 percent at the close after finding indications of oil and gas in the Bounty exploration well in the Norwegian Sea, where Petrolia Noco has a 10 percent ownership stake.

company news

Prior to the exchange’s opening, it became known that the potential sale of the Green Energy Group’s seismic operations had been frozen due to circumstances “beyond the control of the two companies.” The stock plunged about 20 percent after the opening.

Shipping company Stolt-Nielsen, Thursday, reported second-quarter results. The company sharply increased its profit to NOK 663 million from NOK 105 million at the same time last year. Upon opening, the stake is up about 2%.

Norwegian miner Nordic Mining has decided to sell its shares in Finnish battery chemical and mining company Keliber for NOK 483 million. The stock rose about 3 percent on Thursday morning.

In addition, it became known that Bewi Packaging and Styrofoam is selling a property portfolio of NOK 2 billion to KMC Properties. KMC stock rose about six percent at its opening.

DN corrects: In an earlier version of this case, DN wrote that the main index on the Oslo Stock Exchange fell more than 2%. This is due to technical issues with the market data provider. The issue also affects some DN Investor courses.

(Conditions)Copyright Dagens Næringsliv AS and/or our suppliers. We would like you to share our cases using a link that leads directly to our pages. All or part of the Content may not be copied or otherwise used with written permission or as permitted by law. For additional terms look here.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”