In the US, Walmart, Best Buy and a number of other retail companies have warned of weaker results ahead due to higher inflation. Retail experts believe that some Norwegian industries will notice a change in consumers.

For its part, the world’s largest retail chain Walmart reminds that clothing is a particularly weak product, and that the giant will lower prices in the future.

E24 experts spoke of their belief that more expensive goods in the first place may be subject to lower demand in Norway.

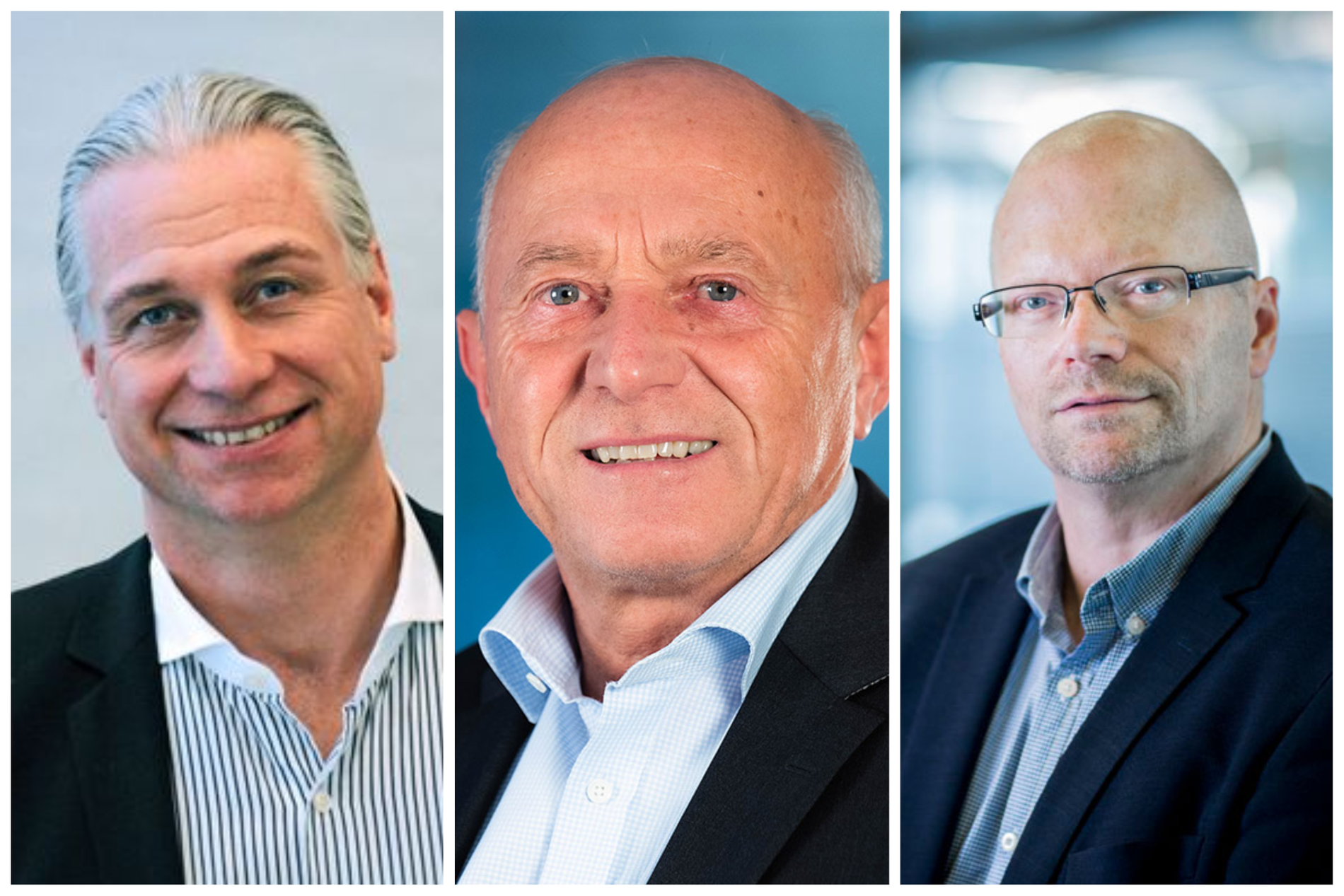

– Varde Hartmark Industry and Market Analyst Reidar Mueller says that those who would reasonably expect to feel the effects the most are capital goods industries such as building materials, furniture, electronics, watches and jewellery, and adds:

– Muller adds that those with a higher proportion of more expensive goods have to resort to discounting more in order to sell the goods.

Robert Engwaldsen, undergraduate lecturer at BI Business School, agrees.

Capital goods such as cars and other things that consumers can put off their purchase are probably most at risk, says Ingewaldsen, who succeeded him several years as mall manager.

Affects buying behavior

Voice CEO Jonny Oatessen expects inflation to affect how people spend their money in the future.

– The manager says that the unusual inflation we are seeing now, and which we expect to continue until 2023, will affect purchasing behavior.

At the same time, it will affect different industries differently.

However, he notes that past experience in Norway’s clothing industry shows that many will buy new clothes, despite the economic downturn.

Clothing is a luxury you can still pamper yourself with even if you can’t afford expensive capital goods, he says.

Smarter Consumers

Professor at the Norwegian School of Economics, Frode Steen, says that certain industries are hurt more than others is not necessarily a fact.

Different product groups are catered for based on raw material prices and labor intensity, and that happens regardless of the industry, says Steen.

The types of products and industries most affected also depend on consumers behaving rationally, according to Mueller.

Everyone becomes more aware in such financial situations, even those with better advice, says Mueller.

The three experts agree that people are becoming more price conscious, are buying more chain brands, are cheaper and are better at shopping for the products they want to get at the right stores.

There are differences in product groups and how negative development affects them. A distinction is often made between so-called luxury goods and essential goods.

The distribution in retail is as follows: You can’t change the size of food products often, but you can wait with other products that you don’t necessarily need, says Stein.

Prefer low price

Frode Steen believes that the grocery industry will be more protected than some other industries.

Ingvaldsen, Mueller and Steen believe that typical discount stores will either notice the development to a lesser extent or benefit from it to a greater extent. Especially chain brands.

Discount stores still have their own brands, and I think we’ll see more of that in such downturns, Engwaldsen asserts.

In the big picture, it has to do with most people wanting to turn off the faucet.

A lower price will benefit more than that, says Engwaldsen.

Acorns believes in normalization

Roger Lund, CEO of Ekornes, says prices for raw materials and transportation have risen, which in turn is putting pressure on the group’s profit margin.

– Last year, we had to increase our prices due to inflation in raw material prices and container prices, says Lundy.

At the same time, we see that strong brands are not price sensitive.

He adds that Ekornes is now seeing a normalization in sales volumes, after two years of exceptionally high activity.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”