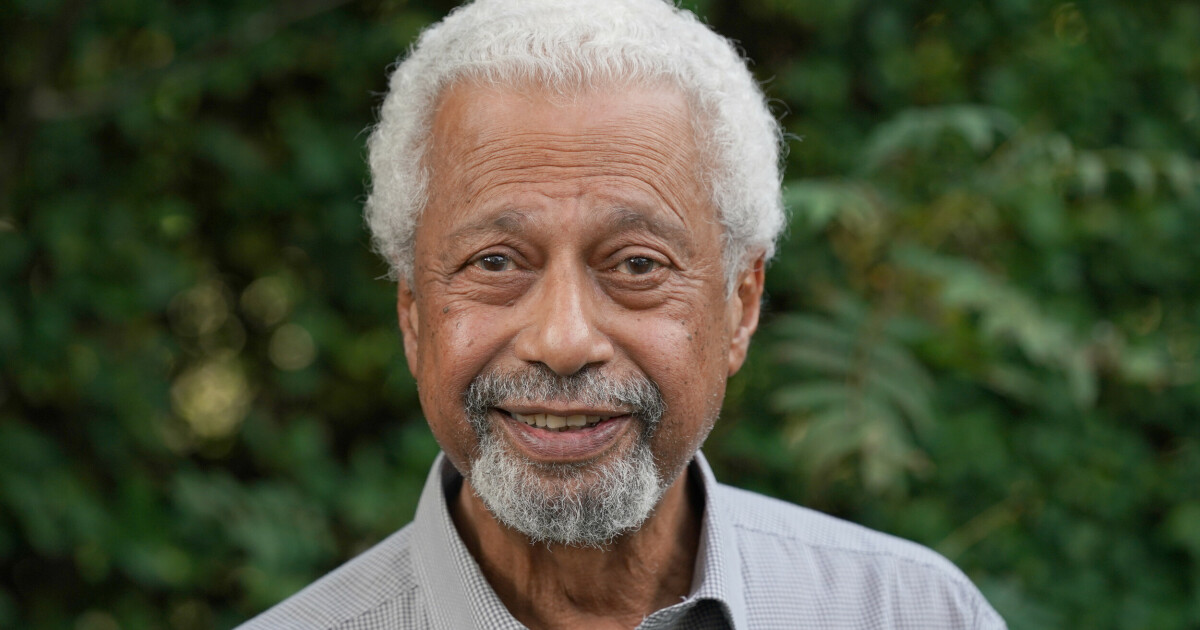

Morton Baldzerson, director of financial supervision, believes the economy is at risk of stagnation and inflation. He warns that sharp jumps in interest rates “underline the severity”.

– We see interest rates to rise significantly further. At the same time, we can get worse growth in the economy, Baldzerson tells E24.

– When we had the global financial crisis, the oil price crash in 2014 and the pandemic, each time stimulus measures were taken, which contributed to raising asset prices. Now, he says, he’s not sure he can face any backlash in the same way.

The director of the Norwegian Financial Supervisory Authority presented a semi-annual report on Thursday “Financial Outlook”The supervisory authority is asking banks to take into account the downturn in property markets.

The background is, among others, high price growth, which contributes to great economic and financial uncertainty.

Read on E24+

Only four out of 20 Norwegian cities have enough affordable housing for private individuals

Norges Bank and several central banks have raised interest rates at a rapid pace to combat high inflation.

Here at home, the central bank has raised the key interest rate from zero to 2.5 percent during the pandemic, and signaled further interest rate hikes to come.

At the same time, companies in surveys by Norges Bank warn of the weakest outlook since 2009.

– The scene hits us hard

Baltserson insists that the property crash is not a predictor of power, but rather a contingency.

He says it is Finanstilsynet’s job to identify risks.

– Then you also need to point out plausible scenarios. We have previously experienced this scenario of stagflation in our stress tests, when interest rates rise and asset prices fall while the economy stagnates.

– That situation could hit us hard due to high housing debt and high property prices.

Stagflation describes the stagnation of an economy at the same time as high inflation, which is difficult for central banks to handle.

Baldzerson says the watchdog believes the scenario is “plausible”.

– Now we have increased inflation, unrest, and monetary policy is being tightened. This is a clear indication that this is a risk that deserves great attention.

The term is known, among other things, for US Federal Reserve Governor Paul Volcker’s sharp increase in interest rates after a period of economic stagnation in the 1980s.

– Then the risk of a stool increases. That’s because we’re exposed to an interest rate shock, with high debt and asset prices, says Baltserson.

– Why is it appropriate to highlight the stagnation situation?

– Because fiscal and monetary policy authorities will have limited opportunities to counter economic setbacks. Need stimulationNeed stimulationMeasures to help demand and the economy during tough times such as increased public spending and interest rate cuts.Because economic policy should be aimed at reducing inflation.

Norway’s solid state finances, which have helped in previous crises, are more difficult to use when inflation is high, says Baltserson.

– Interest rate hikes underline severity

He believes that years of high price growth on housing and commercial properties and high credit growth have created increased “drop height” and “vulnerability”.

– Interest rate hike underlines the seriousness of the matter. Central banks see a major risk of inflation catching on and have raised interest rates from record lows in the short term.

Read on

Norges Bank Survey: Weak outlook since 2009

Baldzerson says it’s important for banks to take into account that mortgage values, the values banks hold as security for their loans, can fall in the housing market and the market for commercial property.

– Banks have capital to account for crises. Such a crisis situation as we have described is characterized by a sharp drop in mortgage values and increased defaults by borrowers.

Confidence in low interest rates

Price growth in Norway remains at a high level. In October, it rose to 7.5 percent, a historic high.

In the US, the world’s largest economy, inflation has eased slightly but remains high.

– It wasn’t that long ago that there was a dominant view in academia and among forecasters that inflation would not rise again, says Baltserson.

– You don’t have to go back very long before the widespread view that interest rates will be low in the long run. Central banks predict it, he says, and you can read it from the interest rate markets.

Read on

Chief Economist in Powell’s speech: – The period of triple interest rate hikes is behind us

Baldzerson said central banks’ first response to increased inflation was that it was “status quo,” before the approach shifted to “a completely different emphasis on the risk of inflation being too high.”

– Do you see a risk of inflation catching up?

– It risks doing so, and it will require a sharp tightening of monetary policy.

– It’s now a compelling film that strikes a stockpiling scene. It wasn’t that long ago.

“Music geek. Coffee lover. Devoted food scholar. Web buff. Passionate internet guru.”