Warnings sounded on television. Hurricane roaring above Philadelphia and large parts of the East Coast of the United States.

The Brik family, who rented an apartment in the city, was in the center of the fire. Lashes on the walls and ceiling. Strong winds, lightning, heavy rain and heavy hail. A window in the apartment was broken.

“We experienced the situation as very tragic and it was too cold to live in the apartment after the window was destroyed,” Brick says of the trip to the US at Easter this year.

The solution was to temporarily move into a hotel for two days until they could find a new apartment.

The hurricane was so strong that the window was blown off and destroyed.

Photo: Ole Anton Brecky

Brekke has travel insurance through If, which uses European travel insurance. A company they own. Brekke was sure they would cover the extra NOK 25,000 bill. But the insurance company rejected this claim.

He claimed the insurance was wrong

– That’s a trifle. We’ve been hit by a natural disaster and why should we get travel insurance when that kind of extra expense can’t be covered, Brick asks.

The family rented an apartment via Airbnb. They tried to get the homeowners, but to no avail.

Airbnb wasn’t helping either, he says. Two nights in a new hotel and apartment within the last 24 hours in the US resulted in an additional expenditure of NOK 25,000.

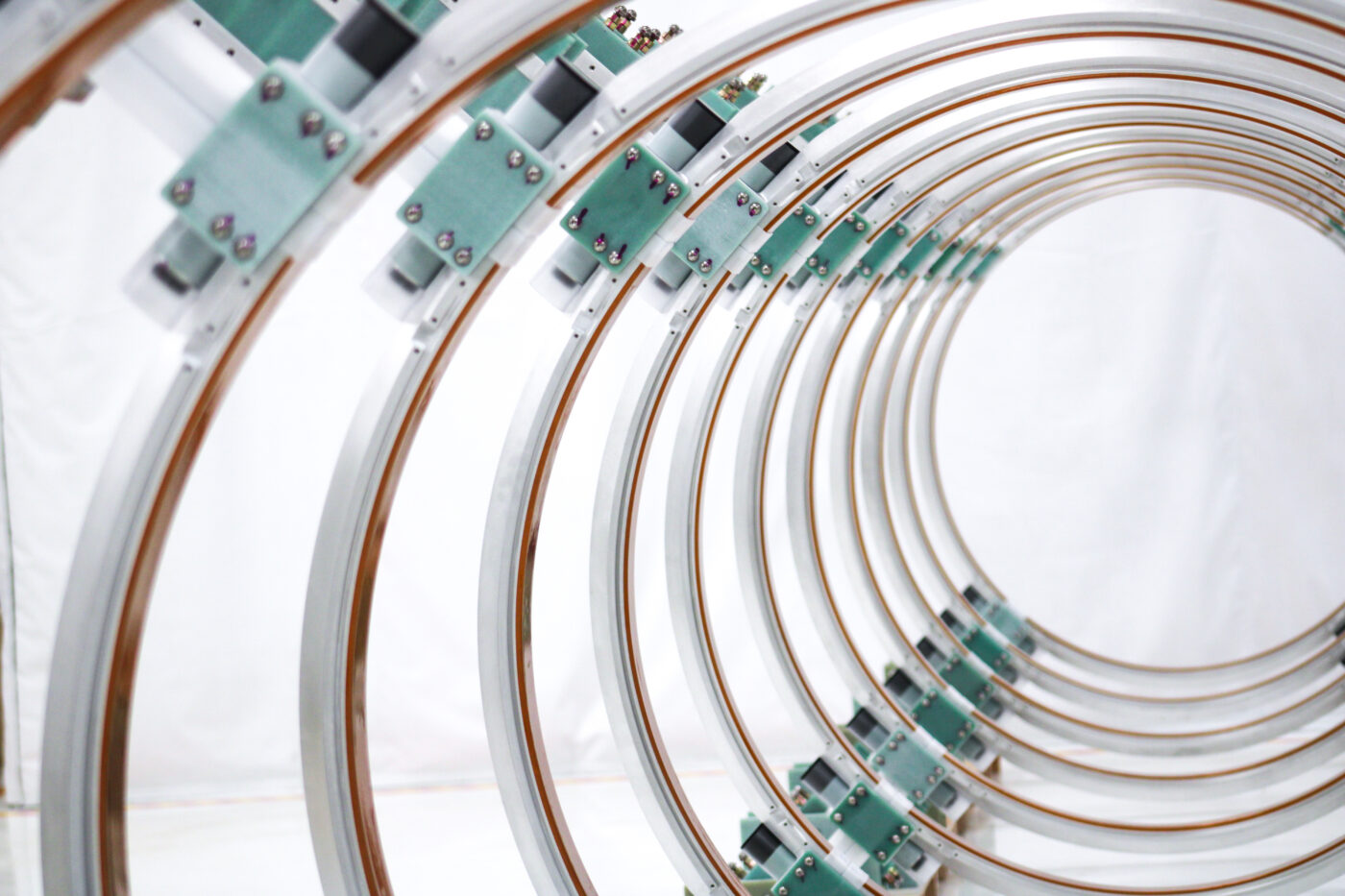

This is what it looked like when the Nordfjord family’s house in Philadelphia was rented by a storm.

The Brekke family has been periodically in the USA every year in recent years, where their son Arne Martin Brekke receives assisted treatment Doman’s method. The 28-year-old has cerebral palsy and is receiving good help from treatment.

The Brekke family has been periodically in the USA every year in recent years, where their son Arne Martin Brekke is receiving treatment for cerebral palsy.

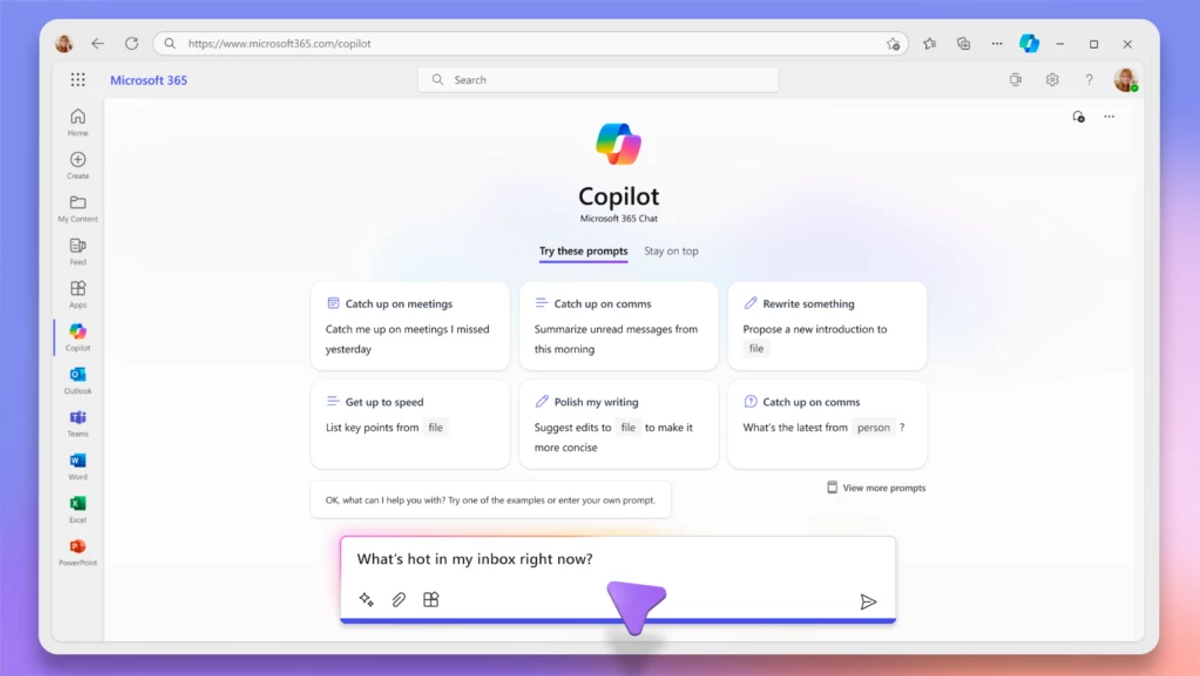

Photo: Bård Siem/NRK

If: – Not enough with the warnings on TV

For its part, the insurance company believes that damage to the apartment is a matter between the homeowner and his brick. It is also indicated that coverage of expenses related to movement due to natural damage becomes relevant only when government authorities warn in advance of bad weather.

– In this case, there is a relationship between the landlord and the tenant, says Sigmund Clements, Head of Communications at If and European Travel Insurance. He adds that Brick can also file claims against the owner’s insurance company.

Travel insurance doesn’t cover everything that happens on a trip, notes Reiseforsikring’s head of communications, Sigmund Clements.

photo: if

– The Brekke family received multiple tornado warnings on TV and had to move out of their apartment due to a natural disaster. Is the insurance company not obligated to cover the additional expenses related to this matter?

– It will only be covered if the local authorities in the country you are in or Norway’s Ministry of Foreign Affairs issue an order to evacuate the area, he said.

– What about using appreciation?

– I would like to be able to do discretionary assessments that go beyond conditions. But that would mean premiums would be much higher and not many would be able to afford them, he says.

Clements points out that a hazard warning on television, which is the equivalent of a hazard warning about severe weather from the Norwegian Meteorological Institute, is not sufficient for travel insurance coverage.

Ole Anton Brekke captured a video recording of the news broadcast on television as it was reported that the storm was about to subside.

The Consumer Council asks people to check the terms

Consumer Council Subject Manager Jorge Jensen understands the family’s frustration. Encourage them to file a complaint Financial Appeals Board If they feel they have been wronged. Every year, the court receives many complaints from people who complain about travel insurance.

At the same time, Jensen points out, it is very common for people who travel to think they are better insured than they really are.

– Often travelers do not know the terms of the insurance contract until after the accident. We want to encourage people to learn about this beforehand, he says.

Jensen also refers to the website Finansportalen.no. Here the Consumer Council monitors the market for you. You can get help comparing and transferring pension products, banking, insurance and funds.

Consumer Council Professional Director Jorge Jensen says many people have not looked into the terms of travel insurance before setting out on a trip.

Photo: John Trygve Tolfsen

I think they did everything they could

In Stryn, Ole Anton Bakke has little understanding of the insurance company’s explanation.

– In natural damage insurance terms, strong winds are one of the terms of payment. You don’t get winds stronger than a hurricane, Brickey says.

If she thinks it’s the homeowner’s insurance company that should cover that, according to Brekke, If’s duty is to cover her policyholders, and then go to the other party with a reversion claim.

– I’m so disappointed. Whoever had to come out with a hurricane warning would have accepted it. President?

– But could you have done anything differently to avoid getting into an argument with the insurance company?

– If we could travel, maybe we could fix the window. But we didn’t have that. The situation was chaotic and I don’t see how we could act otherwise, says Pak, who has decided to terminate the agreement with If Reiseforsikring.

Airbnb wrote in an email to NRK that they are asking the Brekke family to call back, hoping they can help.

The Brekke family lived on the top floor of this building when they were on Easter holidays in Philadelphia, USA.

Photo: Ole Anton Brecky

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”