For several years, experts have warned of China Growth and potential dominance of international politics in the coming decades.

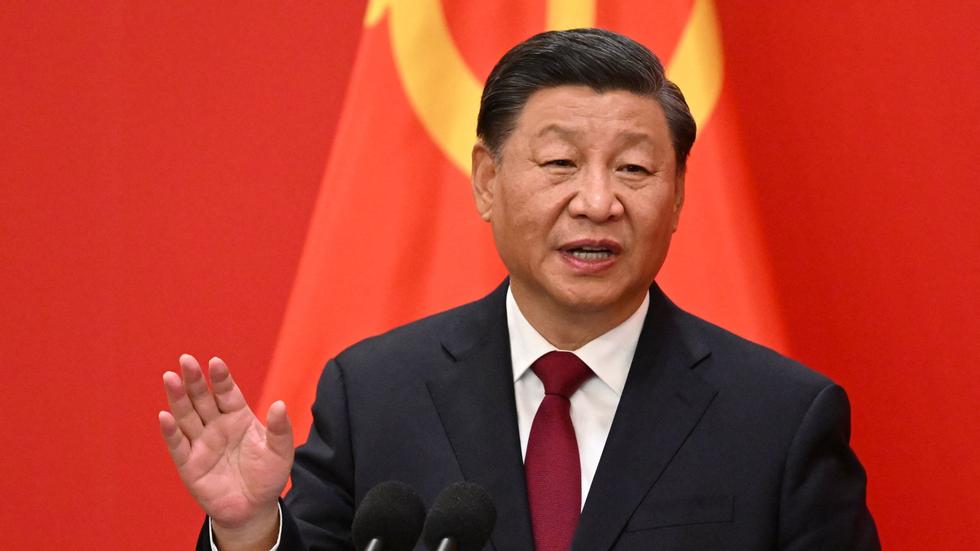

Since coming to power in 2012, Chinese leader Xi Jinping has tried to portray China as an important trading partner for all countries that want to grow in the 21st century. “The Rise of the East and the Decline of the West” was one of his famous quotes.

However, the latest growth and trade figures show a different future for China, and Beijing’s march toward global economic dominance may not be as fast and dominant as many in the West feared.

Deflation and decline in exports

For the first time since February 2021, consumer prices are falling.

The statistics, released on Wednesday, show that China’s consumer price index fell 0.3 percent year-on-year in July. The producer price index – which measures the price of goods when they leave the factory – fell 4.4 per cent in July.

The article continues below the advertisementThe article continues below the advertisement

This means that the Chinese economy has fallen into recession and is a reflection of declining purchasing power and weak consumer confidence, he writes. Financial Times (FT). Deflation is the opposite of inflation, and means that the prices of goods and services fall over time.

At the same time, China has seen a decline in the real estate sector, and weak trade numbers, which also contribute to the slowdown in economic progress.

On Tuesday of this week, statistics were released showing that exports in July fell 14.5 percent year-on-year, the largest drop since the pandemic began. Imports fell 12.4 percent year-on-year in dollar terms, the sharpest decline since January.

In the three years that China was closed to the outside world, Chinese exports helped keep the economy going. But in 2023, rising global inflation and rising interest rates in many countries have led to a decline in demand for Chinese goods.

The article continues below the advertisement

Now the pressure is mounting on the Chinese authorities to take measures to help speed up the Chinese economy.

(Article continues below image).

An aerial photo from July 17, 2023, shows buildings in Shenyang in northeastern China. The latest forecasts show weak numbers for China’s economy. PHOTO: AFP/CHINA OUT

– The Chinese economy now faces the risk of slipping into deflation that could lead to a self-reinforcing downward spiral in private sector growth and confidence, says Eswar Prasad, a China expert at Cornell University, to FT.

The authorities must act quickly and decisively to stabilize growth and limit deflation before the situation gets out of control.

according to FT Chinese policymakers have sought to project confidence in the economy after society reopened from the pandemic, by cutting some interest rates and offering tax incentives to businesses.

But they did not support the big incentives to get the economy moving.

However, the Chinese Communist Party’s Politburo admitted at the end of last month that the recovery was “slowing down,” and said it would “actively increase domestic demand,” he writes. FT.

The article continues below the advertisement

High unemployment rates and low population

Not enough with deflation and weak trade numbers. Youth unemployment is also increasing dramatically.

In the urban 15-24 age group, unemployment rose to 21.3% in June New York times (new).

July’s numbers are expected to be even higher, as this month’s next wave of graduates officially transition from being students to job seekers. The New York Times writes that this will intensify one of the most pressing challenges facing China, which will prevent the economy from regaining vitality.

“If not handled properly, it will lead to other social problems outside the economy. It can even lead to political problems,” says a report from the China Macroeconomic Forum, writes The New York Times.

According to the New York Times, the high unemployment rate is due, among other things, to a mismatch between the jobs people want and those that are available.

The article continues below the advertisement

Today, there is a much larger percentage of young Chinese people who pursue higher education and want jobs in well-paying sectors than there was 20 years ago. This year, it is estimated that 11.6 million students will graduate from universities. In 1992, that number was 754,000, The New York Times writes.

This is reflected in the job market, where the majority of graduates want to work in sectors such as technology, finance and real estate, rather than in industry.

At the same time, there is less supply of this type of work in China, in part because many private entrepreneurs increasingly fear that the state will interfere in business, and have therefore scaled back or moved their businesses out of the country.

(Article continues below image).

Young Chinese university graduates at a job fair in Yibin, southwest China’s Sichuan Province. The unemployment rate among Chinese youth rose to 21.3% in July 2023. (Photo: CNS/AFP)/China OUT

Under Xi’s leadership, the Chinese bureaucracy has introduced strict regulations for many big tech companies, including e-commerce firm Alibaba.

The article continues below the advertisement

In addition, the real estate sector is experiencing significant decline in demand and development. This sector was once China’s engine of growth and prosperity.

The last critical factor for China’s economy from a longer perspective is the country’s declining population.

According to a report from the consulting company Terry group Over the next decade, China will lose an average of 7 million adults of working age each year, which will rise to 12 million annually in the 1950s.

The consulting firm claims that this will have a direct impact on the country’s ability to compete with the United States and other countries around the world Because the greatpopulation decline It has such a negative impact on the economy.

China and Europe

Both the United States and European countries are now reassessing their economic vulnerabilities, and their dependence on supply chains controlled by potentially unfriendly regimes.

The article continues below the advertisement

Western leaders now routinely talk about economic “de-risking” of China.

Recently, there was news that US President Joe Biden is limiting, or nearly banning, certain types of US investment in Chinese technology companies that develop microchips and artificial intelligence.

Italy’s prime minister, Giorgia Meloni, is also preparing to withdraw from an agreement that means Rome will become part of Che’s global infrastructure plan.

President Joe Biden is on a video call with Chinese President Xi Jinping last November, with Russia’s invasion of Ukraine being the main topic. Photo: Susan Walsh/The Associated Press

All of these factors imply that China will not necessarily dominate the global economy in the next century, as many predicted. At the same time, this suggests that China may not be as strong as many in the West fear.

On the other hand, a weak Chinese economy will also have negative consequences for the global economy, as a large part of the jobs and production in the world depends on China.

The article continues below the advertisement

China’s economic and domestic problems may also exacerbate the geopolitical situation among the world’s great powers.

Joe Biden recently stated that China is like a ticking time bomb.

– They have some problems. That’s not good, Biden said during a visit to Salt Lake City, Utah, on Wednesday, because when bad people get into trouble, they do bad things.

For now, it is unclear whether Xi will show a friendlier side, or whether tough economic times in China will instead encourage more conflict to shift public opinion and bolster nationalist sentiment.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”