Investors and companies retreat in times of uncertainty. But financial leaders expect the dry season to end soon.

Only seven companies are listed on the Oslo Stock Exchange in 2023, a number that stands in stark contrast to the euphoria of a few years ago.

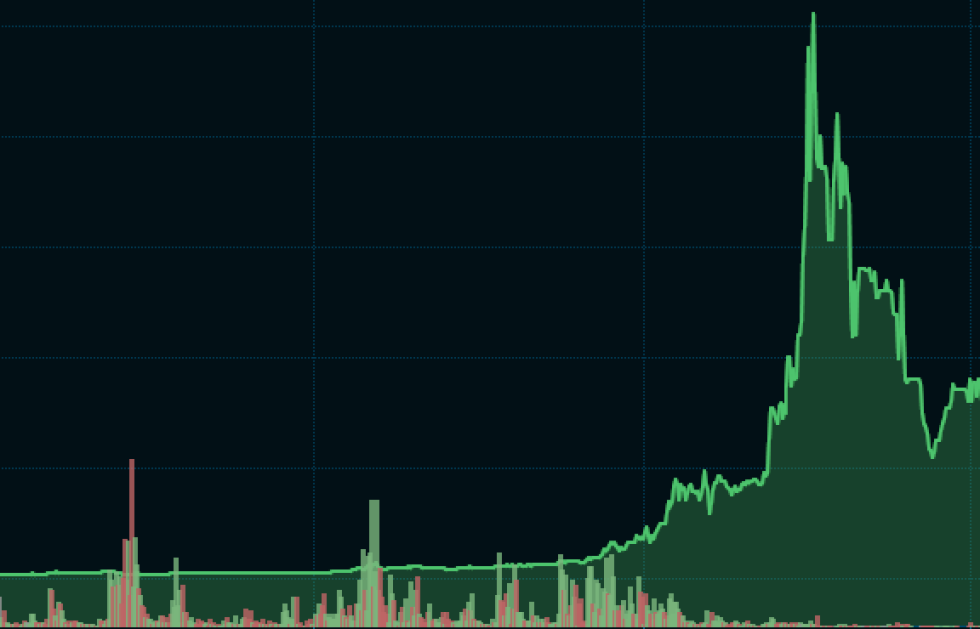

In 2020 and 2021, the Norwegian stock market was extremely hot. Many companies had gone public, interest rates were low, and appetite for risk was very high among investors.

And now she turned around.

Read on E24+

I made three million this year: – Trying to earn as much money as possible with as little effort as possible

Alexander Obstad is the president of DNB Markets, the largest brokerage in Norway. He points out that interest rates have risen and investors are believed to be more uncertain.

– A large number of IPOs have developed very poorly. Obstad says skepticism has become evident among investors who participate in IPOs.

The value of many companies that were listed during the stock market boom has fallen sharply, including the renewable energy sector.

– Riding bicycles

Obstad believes historically strong years should shoulder some of the blame for the decline in listings in 2023.

– We simply got rid of many candidates who had plans for the exchange, says the broker's manager.

An important part of brokerage firms' work is helping companies go public. These tasks are often lucrative and an important source of income for them.

Obstad points out that the number of IPOs goes through cycles.

– There tend to be few and many periods of initial public offerings. In this sense, it is completely normal.

There are now 338 companies listed on the trading floors of Oslo Børs, a historically high number.

The global stock market has performed largely well this year, but the stock market rally has been centered around a small number of stocks, especially in the technology sector, according to Obstad.

– Valuations were not attractive in some sectors. Companies considering going public choose to postpone listing.

– Uncertainty was decisive

One company that had plans to go public was Jordanes, which owns a number of well-known brands, such as Sørlandschips, Synnøve Finden and Peppes Pizza. The company announced in November that the IPO was postponed indefinitely, citing market conditions.

Stock exchange director Øyvind Amundsen says companies are sitting on the sidelines.

– Many companies want to offer their shares for public subscription, but have stopped doing so. We thought things would improve this fall, but then the uncertainty increased with the war in Gaza, says Amundsen.

The stock market is up nearly 10 percent this year. Why won't companies join the boom?

– It was a fairly good year in the stock market, but there were also fluctuations. Many are worried that unexpected things will happen, so the trip will be negative.

Amundsen points out that large initial public offerings, for example in the United States, have performed poorly.

– Several companies declined in the first period after listing. It is spreading all over the world. Then you have to wait, if it is not absolutely necessary. Uncertainty has been crucial for companies that have chosen to wait to list.

Norway's weak IPO year is part of a broader picture. according to Financial Times The value of transactions that took place globally this year is at its lowest level since 2013.

Looking for signs of interest

However, there will be more IPOs in 2024, according to brokerage director Obstad and stock exchange director Amundsen.

Stefan Schander Slimdal is also waiting. As head of the Carnegie Corporation's equity transactions department, he is close to Norwegian IPOs.

– We do not believe that the level of activity will return to 2020 and 2021, but we expect an increase from the past two years to more normal levels. This assumes that expectations of lower interest rates will come true, while avoiding recession in the most important global economies at the same time.

The only thing that makes Slimdal more positive in the coming period is that he once again began to see more interest among investors in small and medium-sized companies. In the Norwegian context, companies are typically worth up to NOK 10 billion in market capitalization.

For there to be a lot of activity among new listings, there needs to be interest in investing in this volume sector, according to Slimdahl. He confirms that this is where most of the Norwegian transaction flow is located.

According to Slimdahl, two years ago investors chose to focus on larger, more stable companies, such as so-called stock market locomotives.

– We are now starting to see signs that this is expected to happen again Trailing returnTrailing returnA return on investment that exceeds what is normal in the market On investments in Small and medium-sized companiesSmall and medium-sized companiesSmall and medium companies-Companies, says Slimdahl.

– Now we see capital flowing back into Nordic mutual funds with a focus on such companies. Historically, this has been an important driver of listing activity, says Slimdahl.

He also points out that several recent IPOs have provided good returns to investors.

Among the year's major IPOs are engineering firm Norconsult and shipping company Dof, which returned to the stock market after bankruptcy. The price of both shares rose after the listing. DNB Markets and Carnegie were among the facilitators.

– Those investors who dared to seize the opportunity had a very good trip. “We believe this will increase the appetite for more IPOs in 2024,” says Slemdal.

Read on E24+

Thomas Nielsen: “A double candidate with limited risks?”

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”