No stock has ridden the AI wave like Nvidia. After the rise sparked by the shocking numbers released last week, we are talking about a huge price increase of 773 percent over the past year and a half, for a company that is now the third largest listed company in the world after Apple and Microsoft.

Fear of heights: Robert Ness, investment director at Nordea. Photo: Ivan Kvermi

Investment Director Robert Ness at Nordea admitted to Finansavisen's Børsmorgen in the wake of Nvidia's report that At today's course levels “you can definitely feel the fear of heights.”

– When the dust settles and the winners begin to emerge, the pace of investment may slow down, while the use of models increases and one begins to think about profitability. If Groq, or others, suddenly came up with GPUs (graphics processors) at a fraction of the price, you'd typically choose them, he said.

Jardel does not dare to buy

Another person reacting to the high valuation, of both Nvidia in particular and AI in general, is one of the strongest investors in the Nordic region; Christopher Gardell. His investment company Cevian Capital is one of the main owners of the Stockholm Stock Exchange.

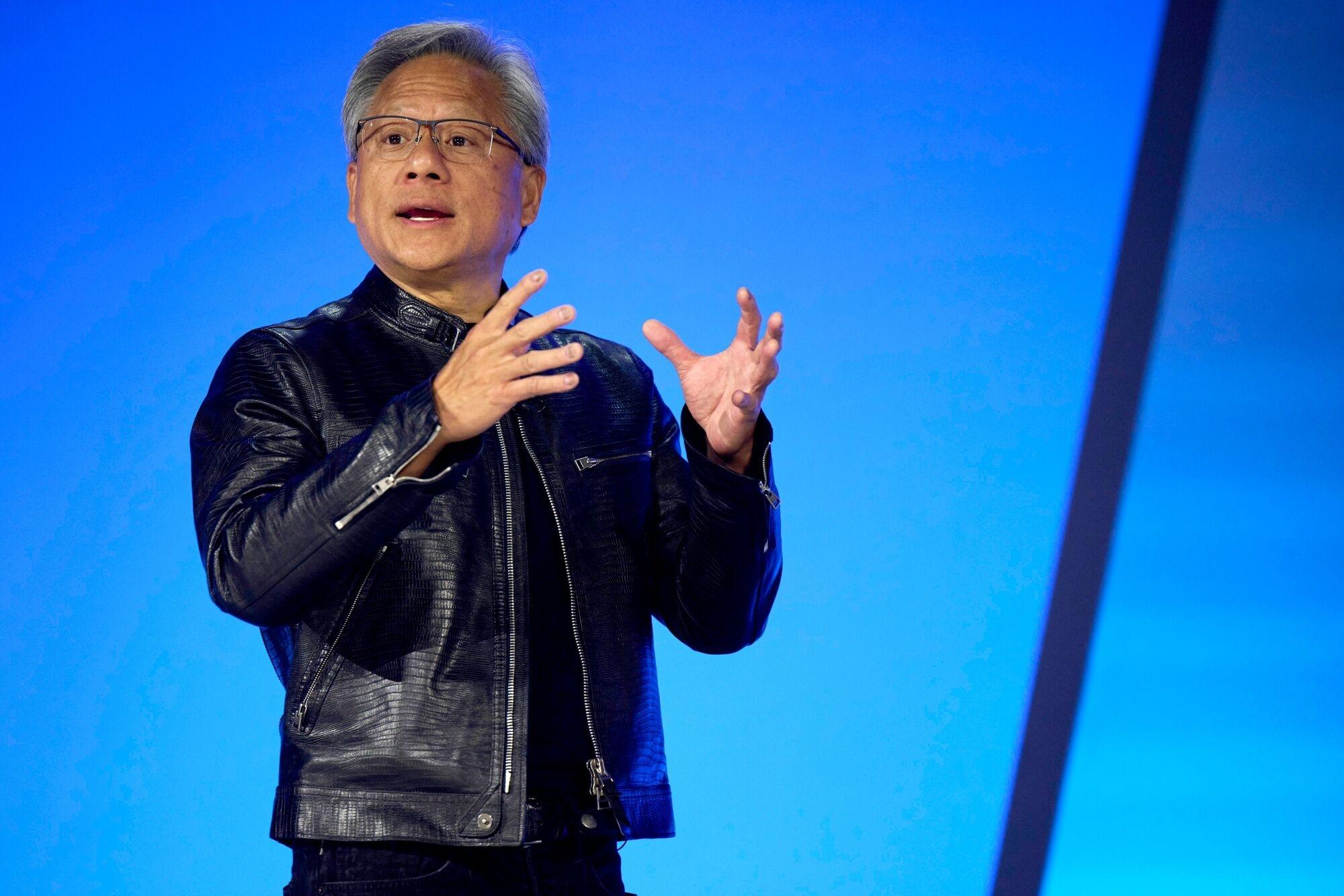

Track Revolution: Nvidia CEO Jensen Huang. Image: Bloomberg

“With the huge amount of stupid index funds in the market, the bubble is always inflated by the hype. Nvidia and other 'hype companies' are almost overvalued. When the bubble is punctured is a much more difficult question,” he wrote according to Swedish media. In an email interview with TT news agency.

“I certainly wouldn't dare buy at these levels. Those who enter now to ride the hype should be prepared to lose a significant portion of their capital,” he adds.

Jardell believes that Nvidia CEO Jensen Huang may be right in his claim that the development of artificial intelligence could pave the way for an industrial revolution.

“But maybe it will take a little longer than the hype hopes,” he continues in the interview.

DNB Fund rejects the bubble

DNB Teknologi managers claimed to Kapital in April that it is wrong to refer to AI as a bubble.

AI-BUBBLE REJECTS: Managing Director Anders Tandberg-Johansen, DNB Technology. Photo: Eyvind Jegeseth

– The pricing of so-called AI stocks is in no way comparable to the runaway pricing during the dot-com bubble in 2000. However, there has been a significant multiple expansion recently, and the companies may have to beat market estimates in 2017, the responsible director said. Anders Tandberg Johansen: “Order them to work.”

He added to the magazine: “We may be in a classic situation that Bill Gates described best when he said that the market overestimates the change that will occur in the next two years, and underestimates the change that will occur in the next ten years.” .

DNB trustees agreed with Næss at Nordea that Nvidia will face tougher competition.

– Nvidia's margins are great, and the company has a very strong position in the market, especially when it comes to training language models like ChatGPT. However, we believe there will be more competition internally Deductionthat is, that part of count – count This is required when putting AI models into use, Tandberg Johansen said.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”