Price increases are slowing in many countries. Over time, it will also serve Norwegian wallets. But we may have to stand in the animal era longer than many others.

We live in an age where vulgar videos on cell phones fuel short-term memory. But even details dating back two years may seem unclear. Not least when the economy and the world are changing so quickly.

For example, most people now pay more than 5% interest on their mortgage. Even those in the worst circumstances overpay for everything 7 percent.

But we remember that the average interest rate on new mortgages was good less than 2 percent Late in 2021? Would we then have much lower monthly interest expenses?

We could move further away from these pandemic interest rates in short order. It is possible that Norges Bank will raise the key interest rate again in September. It is almost a given that banks will follow suit again.

The fact that it is still not clear when the interest rate peak will be reached here at home is not least due to the fact that Norwegian inflation is still very hot. Prices have fallen a bit this summer. But it still hovers in the sky above Norges Bank’s target.

We also have some particularly Norwegian challenges. Among other things are food prices rarely unpredictable, And the rental rates are exceptional love splash. The weak krone can also push up the prices of imported fall collections and tablets. In the pole, prices have gone up higher Friday.

Even a country like Sweden charges consistently high prices. In the eurozone, new offers are emerging number That price inflation is still high. Especially in some countries.

But inflation in the south was generally a little more moderate than in the north. If we eliminate electricity and taxes, the continental average will be a little lower Norwegian level.

Now the belief that the ECB will raise its key interest rate further in September is also starting to recede. It is not entirely inconceivable that the euro countries have reached the peak of interest rates actually.

And they have gone even further with other close business partners. In the US, they started with faster and stronger interest rate medicine than in Europe. This contributed to calming the price fever significantly.

The price figures released on Thursday are what the powerful US Central Bank (Fed) is most concerned about. They show that price inflation in the superpower has now fallen 3.3 percent The last year.

It’s up slightly from last month, but well below year-ago levels. This year, prices have gone from running to trotting. The post-pandemic peak of inflation “there” will probably be a thing of the past.

In this case, that is a milestone. Good news for all of us. The United States dominates financial markets and the global economy. A slower price carousel there will reduce price pressure globally.

Meanwhile, the Federal Reserve affects long-term interest rates and stock markets around the world. And now we may be close to peaking interest rates in the US. Maybe we are all there.

Read also

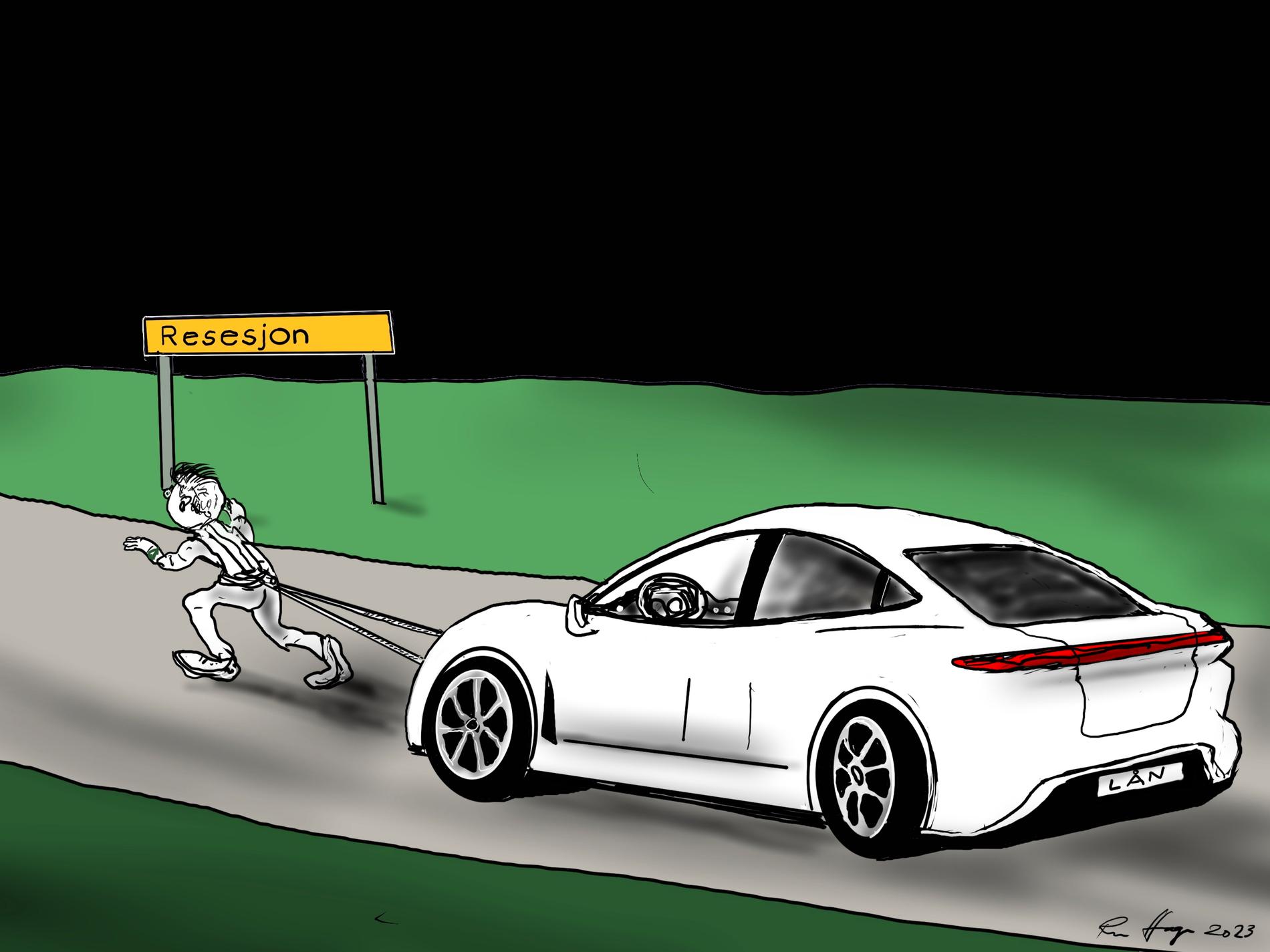

Goodbye to loan-financed fun

The turning point has come. Debt growth has not been lower this century.

Then we have China. Here in fact the prices He falls The last year. He gives great consequences For the “world factory” – and for the planet. Not everything is good at all. Much is not clear. But the so-called deflation in the Middle Kingdom could also lower price pressures internationally.

Then you should never say about inflation. Central banks around the world have been mistaken for large rate gains for many years. It is well known that inflation is difficult to predict. And we shouldn’t rule out new price surprises in a number of places throughout the fall.

But the main trend overseas is now to the downside. In the long term, this will also slow rate hikes at Norges Bank.

But first, a little more explanation about Norwegian private inflation. The scarcity can be longer in Norway than in many other countries. Strong price growth and new hikes in interest rates may continue for some time.

Meanwhile, it could strengthen the weak Norwegian krone in the future. An investor is more interested in placing money with us if the interest rate we offer increases further.

Such a potential strengthening of the krone will have a strong aftertaste with Norwegian mortgage customers. Cheaper Sydney cruises could be swamped by increasingly discouraging loan defaults.

At least there is light in the tunnel. Little Norway cannot live long with large interest rate differentials compared to those with whom we trade the most. Over time, interest rates and peak inflation will approach national borders.

Sooner or later, we can also talk about prices at the trot or walk, not at the canter.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”