Many analysts in the crypto world are waiting for the FTX collapse to have a domino effect, as it has The bankruptcy of Lehman Brothers In 2008, which led to the bankruptcy of many financial institutions such as Washington Mutual.

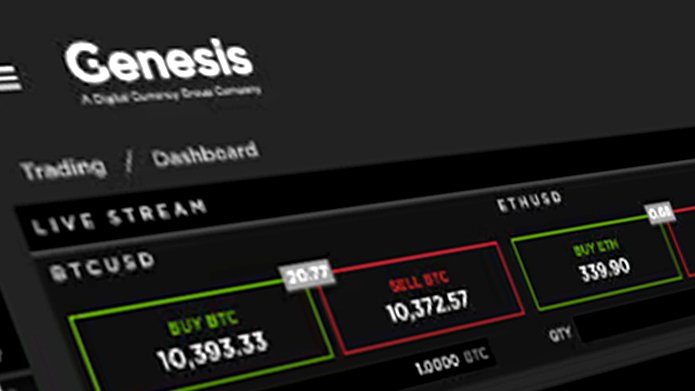

Many people now believe that Genesis is responsible. The company was the first to launch a bitcoin trading platform in 2013, according to their own pages. Genesis is referred to as the largest trading platform by several US media outlets.

Last week, customers were not allowed to withdraw their values from Genesis lending operations. They have this work in conjunction with another player, Gemini.

The “Earn” program in question works like this: cryptocurrency exchanges impart the values of their users to institutional actors. Customers can earn up to eight percent interest on this each year.

Despite the fact that it clearly states this Checked values can be retrieved at any timeYou couldn’t do that last week.

Then they pointed to the sudden bankruptcy of Sam Bankman-Fried FTX Trading Platform. This is one that has made huge ripple effects in the crypto world.

Also Read: FTX Head After Cryptocurrency Crash And Bankruptcy: – He ‘Fucked’

– There are no plans to go bankrupt

On Monday, Gemini wrote on Twitter that they are still trying to resolve the issue so that customers can get a refund for the money they earned through the “Earn” program.

Genesis Partner said Monday Reuters They “have no immediate plans to file for bankruptcy.”

– Our goal is to resolve the current situation without having to file for bankruptcy, a spokesman for the news agency wrote.

Furthermore, the spokesperson is said to have said that they are in talks with creditors.

to me Bloomberg News Genesis is struggling to raise new money for its lending business, and claims to have warned potential investors that they might have to file for bankruptcy if they didn’t receive the money.

Read also

Crypto Crack: An Opportunity for Big Earnings or the End of Visas? Nordea’s investment manager has no doubts

Gemini will also have financial problems. The Wall Street Journal He writes that they attempted to obtain an emergency loan of $1 billion, before stopping the possibility of withdrawing their crypto values.

Tried the competitor

Similar to what FTX did before the company collapsed, Gemini should have tried to contact competitor Binance, he writes. The Wall Street Journal.

Rival Binance wanted to come to the rescue of FTX, but after a short time withdrew from the rescue. This led to the cryptocurrency exchange application Bankruptcy protection in the United States of America. In addition, Bankman-Fried has resigned as CEO of the company.

In the case of Gemini, Binance reportedly said it would not invest for fear of future conflicts of interest.

According to the article, Genesis also should have approached Apollo Global Management. The company is the so-called private equityA company that invests in companies that are not listed on the stock exchange.

Also read: Chaos and collapse in the world of cryptocurrencies: bankruptcies and a massive drop in prices

FTX breakdown

Last week, it became known that FTX was short of money. The man behind it, Sam Bankman Fried, had assured the market and investors that all was well with the company.

He was among the world’s richest people following the success of the cryptocurrency exchange and Alameda Research Fund.

Then the balloon exploded, and a lot happened in a short time. she was mentioned that Bankman-Fried was in contact with investment funds and other investors to obtain crisis funds. When he didn’t get a bite out of them, he finally ended up with the competitor who initially agreed to help, but then backed out.

Then it was speculated that the company had lost up to eight billion dollars that customers wanted to withdraw.

FTX then filed for bankruptcy, and Bankman-Fried stepped down as CEO of the company. In time since then it was Chaos and collapse in the crypto world.

On Monday, Bitcoin fell below $16,000. In comparison, the cost of one bitcoin was $64,000 in November 2021. Aside from a rapid drop at the beginning of November, the price of bitcoin has not been this low since November 2020.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”