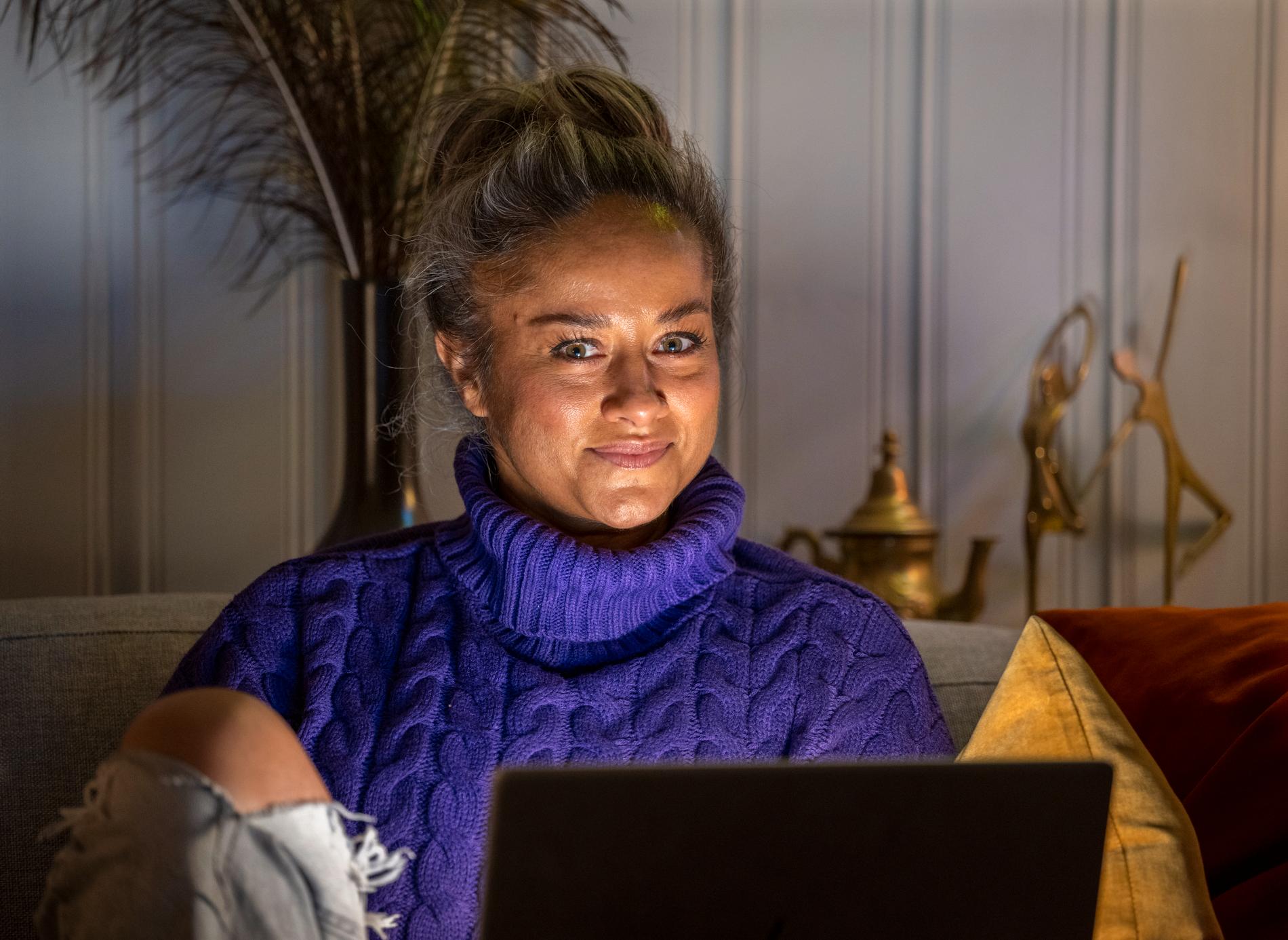

Earlier salary alone was enough. Maria Voss (43) didn’t live a life of luxury, but she managed. This is no longer the case.

– I have a normal job and income, but now it has suddenly turned into a low-paying job, says Maria Voss.

He lives in Traman and has four children. She usually works in the municipality, but has a background as a dancer. As a former dancer, she is also likely to take on a number of odd jobs.

He is choreographing a concert in London when Viji calls. He’s on Robinson’s season this year and all is well on social media.

But the picture from outside is not always correct.

Full fridge – empty account

Salary is not enough anymore. Voss says she’s always managed well, but over the past year her wallet has become emptier and emptier.

– Now I am suddenly poor.

Admitting that is a bit far-fetched, he says. She doesn’t like to complain. There are always people who have it worse.

– I have a full refrigerator, but no money in the account.

Are you one of those who are in financial trouble? Do you receive social assistance or minimum benefit? Have you taken out consumer loans to get things done? Contact a DinePenger journalist here.

It was later reproduced in a post on Facebook Drama 24 She writes that it was obviously not her fault.

“The fact is, I have two weeks minus NOK 9 a month in my account, and I still haven’t paid the dance fee of NOK 5,000 (and the semester ends in a month)”She writes.

She always does it, but it takes a lot.

“When I fill out the poverty calculator for Church City Mission, I live on NOK 5,000 below the poverty line. A month!!!” She writes.

Pssst! Iulia (29) has found a simple way to earn an extra thousand Swedish kroner every week – completely tax-free. And there are more options for those who want Get money fast.

High demand

A lot has happened in Norway’s economy in the past year. Interest rates have been raised 6 times, inflation is high and food prices have risen by 12 percent.

NGOs report an increase in the number of people in need of assistance.

– It is clear that there are more families with children, and lower wage groups. But it’s clear that those who had a hard time at first had it harder than that, says Per Christan Rålm, general manager of Matsentralen Norge.

He says he expects to distribute 10 to 11 million meals this year. This is an increase of 35 percent.

– We are worried about how December will be.

While there is help, getting there isn’t always easy.

– Some people are uncomfortable collecting food. We have many people who communicate a little more anonymously. For example, you agree to meet in the car park, says Ralm.

Voss has borrowed children’s seasonal equipment from Kirkens Bymisjon. Besides, he did not use the help of NGOs like collecting food bags.

– People think it’s not for me, it’s for the poor. But then I was myself.

It is not always easy to see who is suffering economically. Voss says he doesn’t think it’s financially tight. Precisely because it makes asking for help more difficult.

– I do everything so that it does not show. At least in a way that kids won’t notice.

Habits are hard to change

Professor Ellen Kathryn Niehus of Akter University explains that people’s financial situation affects how they feel psychologically.

– At worst, research shows it can contribute to the development of depression. You can become so depressed that you can’t afford it and suddenly feel worse than before. Some people are embarrassed to not be able to afford it, says Niehus.

He teaches consumer behavior, behavioral psychology, and behavioral economics.

If you are the only one in your group of friends struggling financially, this is also a burden, he says. Then the social pressure to spend money can feel stronger than before.

– Habits are hard to change. If you have habits you can’t afford, you may feel sad about having to give up something that brought you joy.

For Voss, being social is key. Cinema trips, cafe visits and restaurant dinners had always been an expense for her, but now they were a luxury she could not afford.

– Good mental health is a rich social life. Being with friends and being outside is very important to me. When the price goes up, I’m afraid I’ll stay home.

She has previously worked as a dancer and has had the opportunity to take on additional tasks to earn more money.

– But you don’t want to work all the time to survive. I like to be with children.

Pssst! Interest rates are rising, but there are still many things you can do to save thousands on your mortgage. Read on for three steps every mortgage holder should take.

“Music geek. Coffee lover. Devoted food scholar. Web buff. Passionate internet guru.”