A new wave of infections and hospitalizations in the United States has caused a lack of liquid oxygen, forcing Atlantic Sapphire to take drastic steps to save salmon at its Miami facility. The stock fell 22 percent.

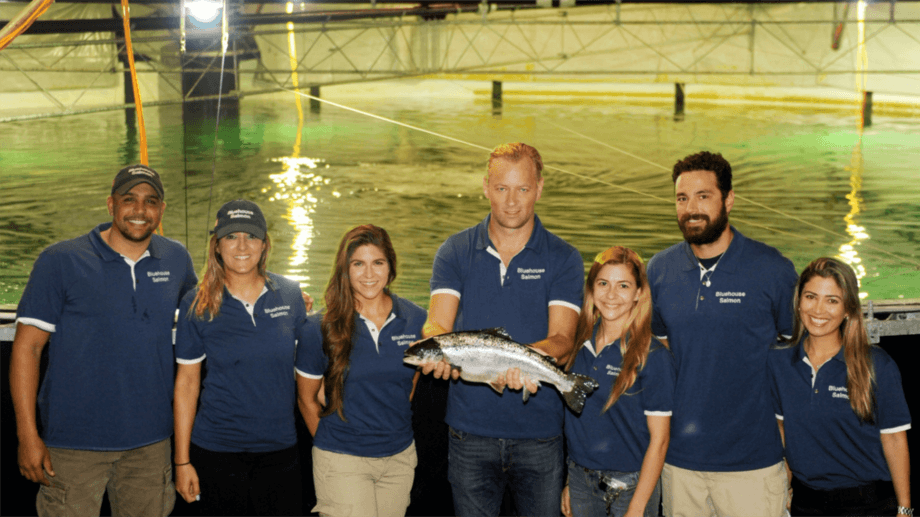

Hypoxia: Johann Andreessen (center) and Atlantic Sapphire are not getting enough liquid oxygen for a wild fish farm in Miami.

– We’re in an unparalleled position.

Johann Andreessen, CEO and owner of the store at Atlantic Sapphire, briefed participating investors on a conference call Thursday night.

Wild salmon farms suffered many technical problems and large scale fish deaths in the past year, and now a new situation has arisen which results in sand in the machine.

The United States was hit by a fourth wave of coronavirus infections, and the number of hospitalizations rose dramatically. At the same time, a new and more effective treatment method is being used in which patients are given oxygen through the nose instead of the mouth.

This has led to a shortage of liquid oxygen in the market, Andreessen said, and we don’t feel confident in ensuring the necessary access for our fish.

Atlantic Sapphire is building a massive wild salmon farming facility outside of Miami. A stable oxygen supply in water tanks is critical to fish survival.

– So far, we have taken measures to reduce oxygen consumption. Among other things, we lower the temperature in the plant and stop feeding the fish, so that they stop growing. We also slaughtered 100,000 fish at somewhat less weight than planned, Andreessen says.

Atlantic Sapphire shares fell 22 percent a little less than an hour after the exchange opened on Friday.

Read also

Earns on Canadian Salmon Stop

Of course it’s expensive

During yesterday’s conference, an analyst was asked how long the company could hold out in the current situation.

– Now we cut the bones with our consumption in mind, preserving the fish. The short answer is that salmon can live for several weeks without food. But Andreessen said that for us it’s very expensive of course, it’s like an oil rig that doesn’t produce oil.

He added that he hoped the company would start feeding salmon again soon, but would work by all means to avoid running out of oxygen.

We think it’s going well, said Andreessen, but of course the situation is of great interest to us.

Atlantic Sapphire has a total of 1 million fish available for slaughter during 2021, equivalent to a production of about 3,000 tons.

Read also

Expect strong salmon prices after a new outage for Norway’s “rival”

1.2 billion lost.

Atlantic Sapphire incurred a loss of NOK 453 million in the first half of 2021 out of total sales of NOK 29 million.

In the past five years, accumulated losses have exceeded 1.2 billion. Before the summer holidays, investors had to turn over a billion in new capital.

E24 wrote at the time that neither Andreassen nor his partner Bjørn Vegard Løvik, who were the two largest owners of Atlantic Sapphire through their joint venture company Alsco with 12 percent of the shares, had subscribed to the issue. It was thus reduced to 10.7 per cent.

Real estate billionaire and board member Runar Vatne, as the company’s third largest owner with 5.6 percent, also did not invest new money in the salmon company, and it was reduced to five percent.

– They were really good at raising the price, before a problem we really knew arose. Investor Svend Egil Larsen told E24 on the matter in June that it was impressive that they spent ten days raising the price.

Read also

The president boosted the market before the release – he doesn’t buy the shares himself

The stock has more than halved since a peak of 150 NOK in February, and is down 34 percent from its last issue price on June 4.

Efforts are now being made to secure funding for the next development phase of the Miami plant, which is estimated to cost nearly NOK 2 billion. The company plans to finance a significant part of this amount with debt, and is in dialogue with its main bank DNB.

The goal is to reach a production capacity of 220,000 tons by 2031.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”