Municipal-owned Glitre Energi transfers NOK 1 billion to the production company after massive changes in the value of “guaranteed” electricity.

Energy company Glitre Energi is taking steps to counter the turmoil in the financial power market.

After its market positions experienced a significant loss in value, the company transferred 1 billion kroner from the parent company to the production company Glitre Energi Produksjon.

It happened through a case in which the parent company Glitre Energi subscribed to all new shares. The decision was taken at the Extraordinary General Assembly meeting on August 23. The reason is “the need to strengthen the equity of the company.”

valve loss

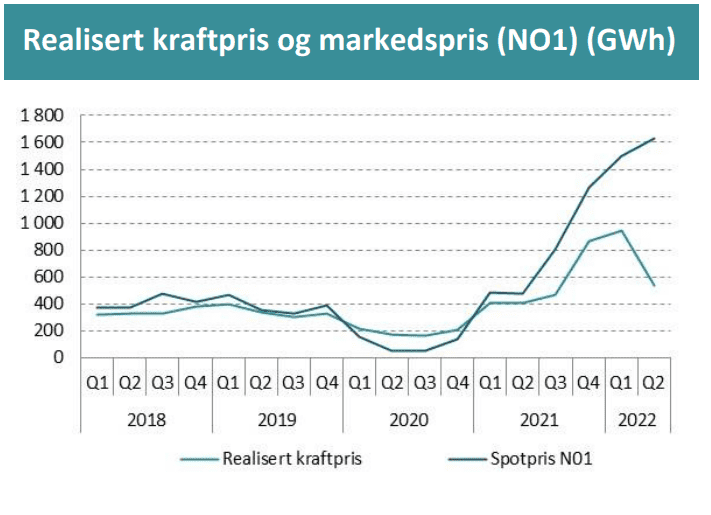

Like many other energy producers, Glitre Energi has long-term contracts for the supply of electricity at a fixed price. This is called “price hedging” and should give the company a more predictable income.

When the market price of electricity is higher than the price they got, the contracts become less valuable. This has a direct impact on the equity of the company.

Glitre Energi suffered an unrealized loss in energy protection of NOK 1.7 billion in the first half of this year.

In addition, Glitre Energi and other players involved in price hedges on the Nasdaq market must provide significant amounts of collateral, as a result of higher electricity prices.

This guarantee, called Margin Requirement, must be provided at short notice.

– As it is now, we have raised capital and converted debt into equity. We regularly make adjustments to the capital structure of our wholly owned subsidiaries, either by adding capital or withdrawing capital as dividends or collective contributions, says Pål Skjæggestad, CEO of Glitre Energi.

Did you do that because of the energy crunch, the high margin requirements that came from the Nasdaq?

– Yes, the production firm should be as well equipped as possible in a highly uncertain market with the development of the demanding market.

Read on E24 +

The market that can topple the giants of power

There are no new contracts

The energy producer is owned by the municipality of Drammen and 18 other municipalities in the former Buskerud. The company accounts for about 2 percent of Norway’s energy production, according to the company.

– Is there a risk that the owners, Drammen municipality and others will have to bring money here?

– No, we have very good control. We haven’t hedge contract price since 2021 and all of our hedging contracts are in safe physical production from our river power plants. In other words, we have no trading activities or speculative positions, just hedging contracts for actual energy production in the future, says Skjæggestad.

– But we note that the market is very uncertain and prices can move in any direction. Much of the development has to do with what happens outside the borders of Norway, but of course also what we get from precipitation the rest of the year.

Can’t take advantage of higher prices

Despite the high energy prices, Glitre was unable to take advantage of the high energy prices.

The company states that it produced less electricity this year than last year, and sold it at 67 percent less than the market price in 2022.

– We only have river power plants, and they have been very dry for the first half of the year and are still dry. That’s in combination with those with reservoirs above rivers blocking the water, Glitre Energi’s chief financial officer Haakon Levy told E24 last week.

turmoil in the financial power market

Last week E24 discussed how the financial energy market could become a major problem for Nordic energy companies, even in a period when energy prices are higher than ever.

The Swedish, Finnish and Danish governments came to the rescue with liquidity guarantees for Nordic energy producers. These guarantees amount to several billion crowns.

The turmoil in the energy markets has led Nasdaq to demand more security from many of its members, who often have to deliver several million in a very short time.

Earlier last week, Tafjord Kraft manager described the hedging instrument as a “giant risk tool.”

Do you have any tips on topics in this case? E24 is based on tips from our readers. Contact an E24 journalist by email ps@e24.noOr by encrypted message via Signal or WhatsApp at +4799240017

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”