Despite numerous attacks on ships in the Red Sea, the situation did not contribute to any immediate jump in oil prices.

But this is a development that could contribute to raising oil prices, according to what he said CNBC. CNBC quoted analysts who believe that the confrontation with Iran, which in turn leads to unrest in the Strait of Hormuz, could lead to a significant rise in oil prices.

“If you have a disturbance in the Strait of Hormuz that lasts for a month, prices could rise by 20 percent,” Dan Struyven, head of oil analysis at Goldman Sachs, told CNBC.

He believes that ship traffic through the Red Sea can be sent via other routes, but oil traffic will not be able to take any alternative route if the strait is closed.

The oil analyst believes that if a situation arises where traffic through the Strait of Hormuz is closed for an extended period of time, it could lead to the price of oil doubling.

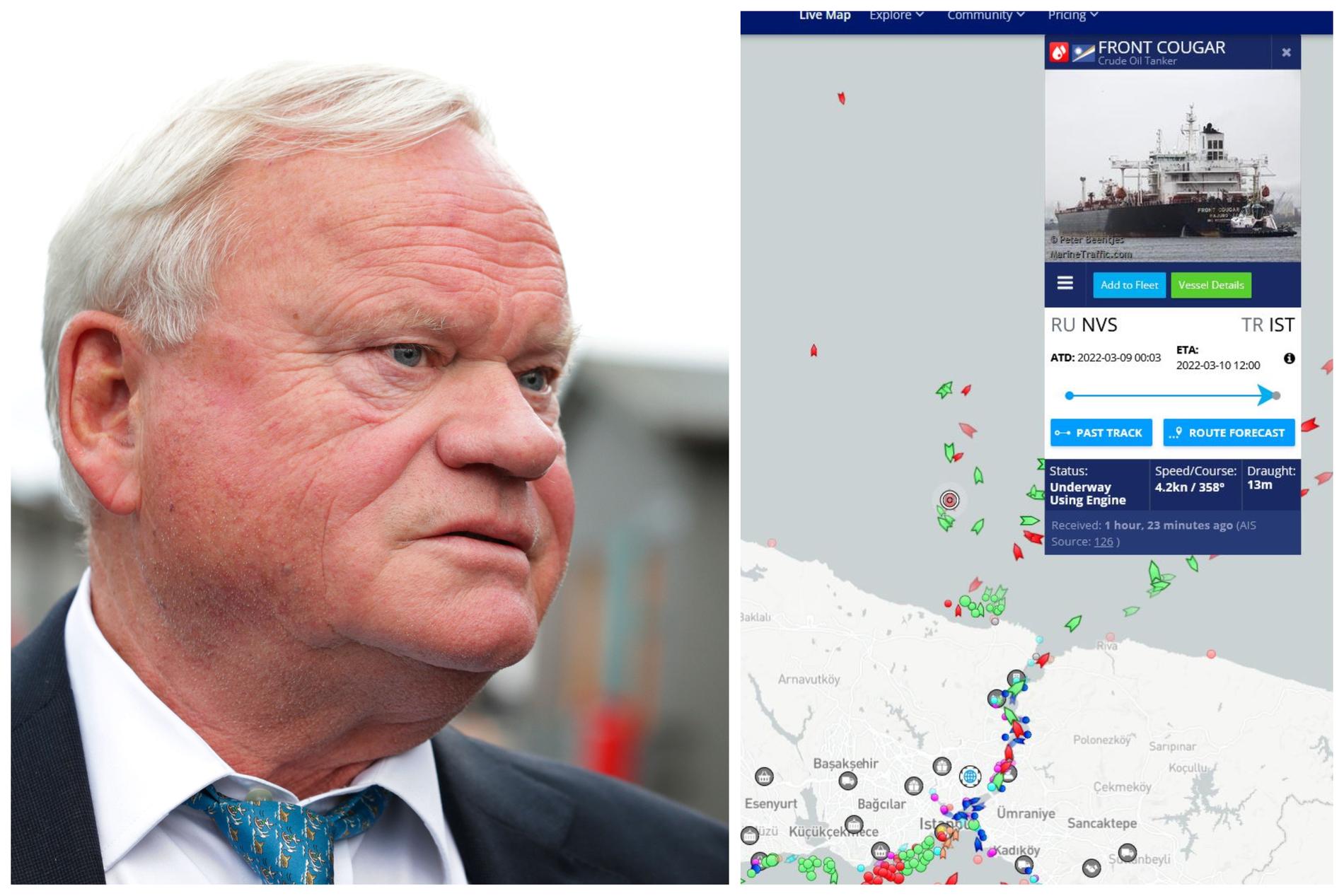

Although analysts at Goldman Sachs believe that the scenario is unlikely, Bob McNally of Rapidan Energy Group believes that there is a 30 percent chance that the conflict in the Middle East will escalate and that Iran will be drawn into the conflict.

At the same time as tensions are rising in the region, McNally believes the market is not taking into account the risks of oil supply disruptions.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”