Telenor has been the season of grief this year with a yield of minus 29 percent, and at the time of writing the stake is at NOK 91. Now, the mega-bank Goldman Sachs is pouring more fuel on the fire, and in a recent analysis, the price target has been slashed from NOK 107 to NOK 80, implying a 12 percent drop.

By comparison, the telecoms sector has a 33 percent gain, according to Goldman Sachs, which maintains a strong sell recommendation.

“We see a downside to consensus estimates for 2023 due to high cost inflation and short-term limitations on price potential within digital infrastructure,” Goldman Sachs wrote.

Cut estimate

People crunching the numbers revised the EBITDA and free cash flow estimates up 3 and 6 percent, respectively, from 2022 to 2024.

In the analysis, Goldman Sachs wrote that Telenor will have weaker growth than the segment through 2025, and has limited potential to participate in the consolidation of the European telecom market.

“We note the opportunity to explore structural opportunities with respect to Asian assets, which could help streamline Telenor’s valuation. However, management noted that while this is likely to be on the agenda, nothing is likely to happen within 12 months. -18 months ahead,” is the message from Goldman Sachs.

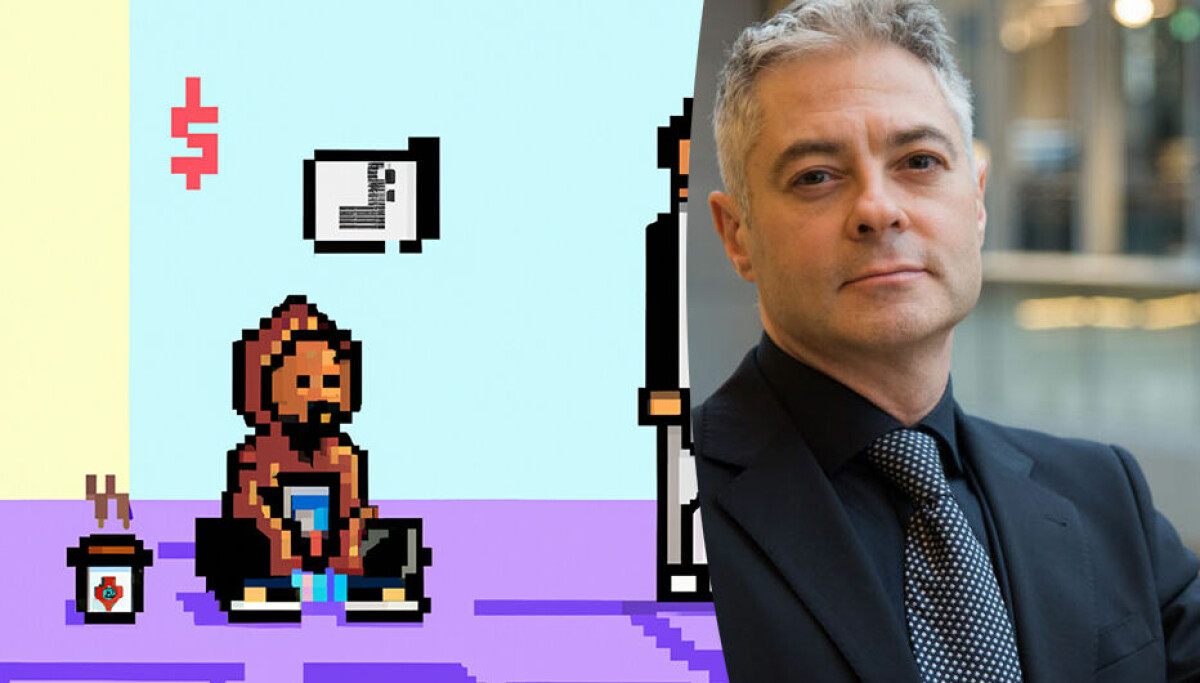

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”