German retailers in Rebellion of the Stars:

German Mercedes dealers are raging against the chief executive’s strategic choice to prioritize luxury cars. They claim that sales are declining and warn of the risk of total failure.

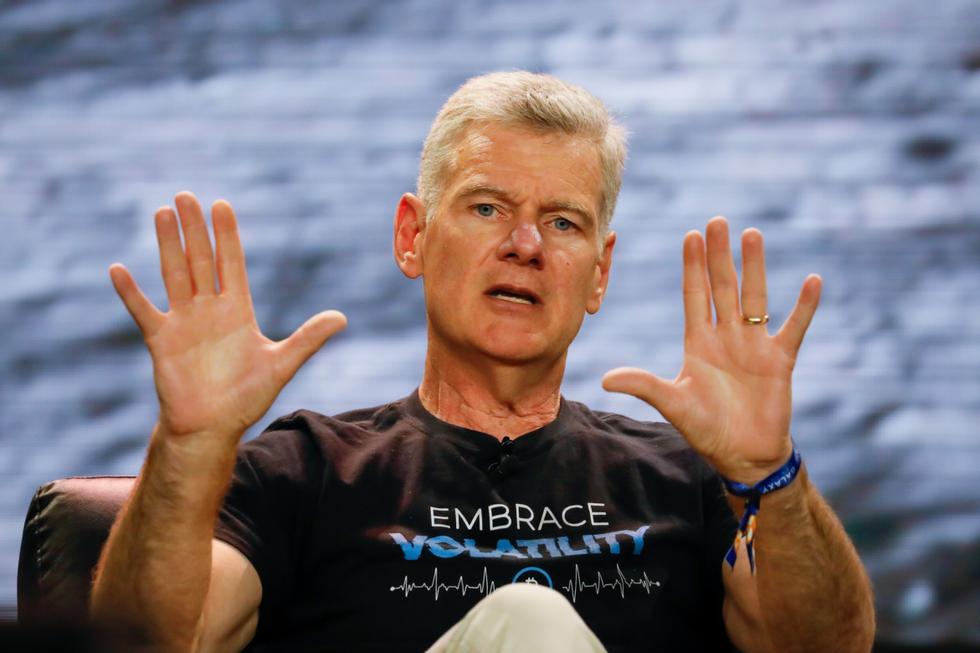

This is what many German media are writing this week, after a four-page letter from the Mercedes Dealer Association was published on the website. Business interested. In the letter, Swedish CEO Ola Källenius was criticized for his choice of strategy, in which luxury cars were given clear priority.

acknowledge Mercedes He writes that the situation may appear rosy on the surface:

Sales figures for the second quarter showed six percent growth, while the first half of the year ended with a five percent increase over the same period in 2022 — and it sold 1,019,200 vehicles. Sales of luxury models increased by 12 percent, while electric vehicles grew by 123 percent (to just over five percent of total volume).

But according to the German press, Källenius is being abused by the German dealer network, which now lives a very different daily life than stock market numbers tell us.

Have you read these cases?

sales decline

Strong price increases have greatly reduced demand. The union says the volume of demand is dropping every day, describing the situation as catastrophic.

It is clear from the dealer association that the choice of strategy would be a complete failure for the Mercedes brand, at least in the German market.

It’s not just price hikes and the primacy of luxury cars that are causing the storm. The association is also very critical of the introduction of expensive, fully specified equipment packages, rather than the previous opportunity to purchase the additional equipment a customer actually wants.

The package scheme, which is very popular in the Norwegian market, for example, provides savings at the production stage, but many dealers in Germany claim that it only contributes to making already expensive cars even more expensive.

image problem

Dealers report that cancellations occur in large numbers on cars in the price-sensitive mid-range segment (A- and B-Class models) as a result of the arrangement with equipment packages.

And it affects the Mercedes C-class models, which have been very popular in the large fleet market. Now dealers claim that large customers are opting for the Audi A4 and BMW 3 series instead.

And above it:

The luxury strategy gives them a strong image problem, claim retailers, who believe that luxury indicates greed. In this case, the impression cannot be compensated for by discounts.

Forget youth

The Distributors Association warns of negative impacts in all sectors and markets. They fear the E-Class will lose ground among German taxi owners as a result of the price hike.

Higher prices mean the company will lose the position it has worked so hard to win among younger buyer groups. MercedesBlog writes that former CEO, Dieter Zetsche, had one of his main goals to reduce the average age of Mercedes buyers to under 40.

This ambition is now deeply rooted.

China flop

In its criticisms, the Merchants Association points to more factors than developments in the local market. Because while new Chinese brands are challenging European traditionalists here in Europe, European car brands are facing an increasingly difficult daily life in China – which is, after all, the world’s largest car market.

Mercedes opted for steep price cuts, after its top-of-the-line EQS model only sold about 100 copies a month in China.

The price of the EQS 580 4Matic has been cut by more than 20 percent (about NOK 330,000), while the EQE has been cut by 10 percent – prompting MercedesBlog to question what kind of margins the company is actually operating with.

“Kaleneos’ strategy of selling as expensive models as possible turned out to be a major failure in China,” she says.

But EQS sales aren’t just in China. Mercedes sold nearly five times as many S-Classes as the EQS on a global basis in 2022.

Among other things, price is part of the explanation for the gap, because the EQS is much more expensive than the S-Class in markets without electric vehicle incentives.

Most read on Motor.no in recent months:

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”