Tek shares have soared lately due, among other things, to the rise of Nvidia. But not everyone is sure to proceed.

Over the past week, technology stocks have performed strongly on Wall Street, helped by the rise of computer chip maker Nvidia.

A week and a half ago, the company reported better-than-expected earnings for the first part of 2023. At the very least, Nvidia expected its sales to be 50 percent better than what Wall Street analysts expected, due to demand for industrial chips. Intelligence tools.

Exhilarating expectations contributed to the real share increase for both Nvidia and other major computer chip manufacturers. The technology sector in general has also performed well.

“In the context of Nvidia, AI will create some winners and some losers… more losers than winners,” says Rajeev Jain, chief investment officer and founder of GQG Partners. financial times.

Read on E24+

Racing AI: – Understands that people are afraid

Nvidia’s share is up nearly 30 percent since the quarterly report was released. Earlier this week, the company’s market capitalization exceeded 1,000 billion at most, which it has slipped slightly.

In the same period, the Nasdaq Technology Index rose about six percent.

“The most obvious winners right now, next to Nvidia, will be the biggest tech names, whether it’s Alphabet, Apple or others like that,” says Jain.

The investment manager asserts that it is difficult to predict the winners except for a few. On the losing side, he points out, some software and IT companies may become redundant and outpace the competition.

You will be careful

Although technology and AI stocks have soared in the stock market recently, there is concern among some investors that AI companies are now overvalued.

Edmond de Rothschild Asset Management, which has been inside Nvidia for a long time, has begun scaling back its bets on the stock, Edmond de Rothschild wrote. bloomberg.

Investment manager Benjamin Melman told the news agency that the manager’s predominance in stocks is now much less than it was in the past.

Should we add more AI technology? We’re less sure of that because the ratings are so high, he says.

Read on E24+

After the euphoria of AI, comes the bill

– If the gains continue, we’ll be more cautious, Melman continues.

Increasing request

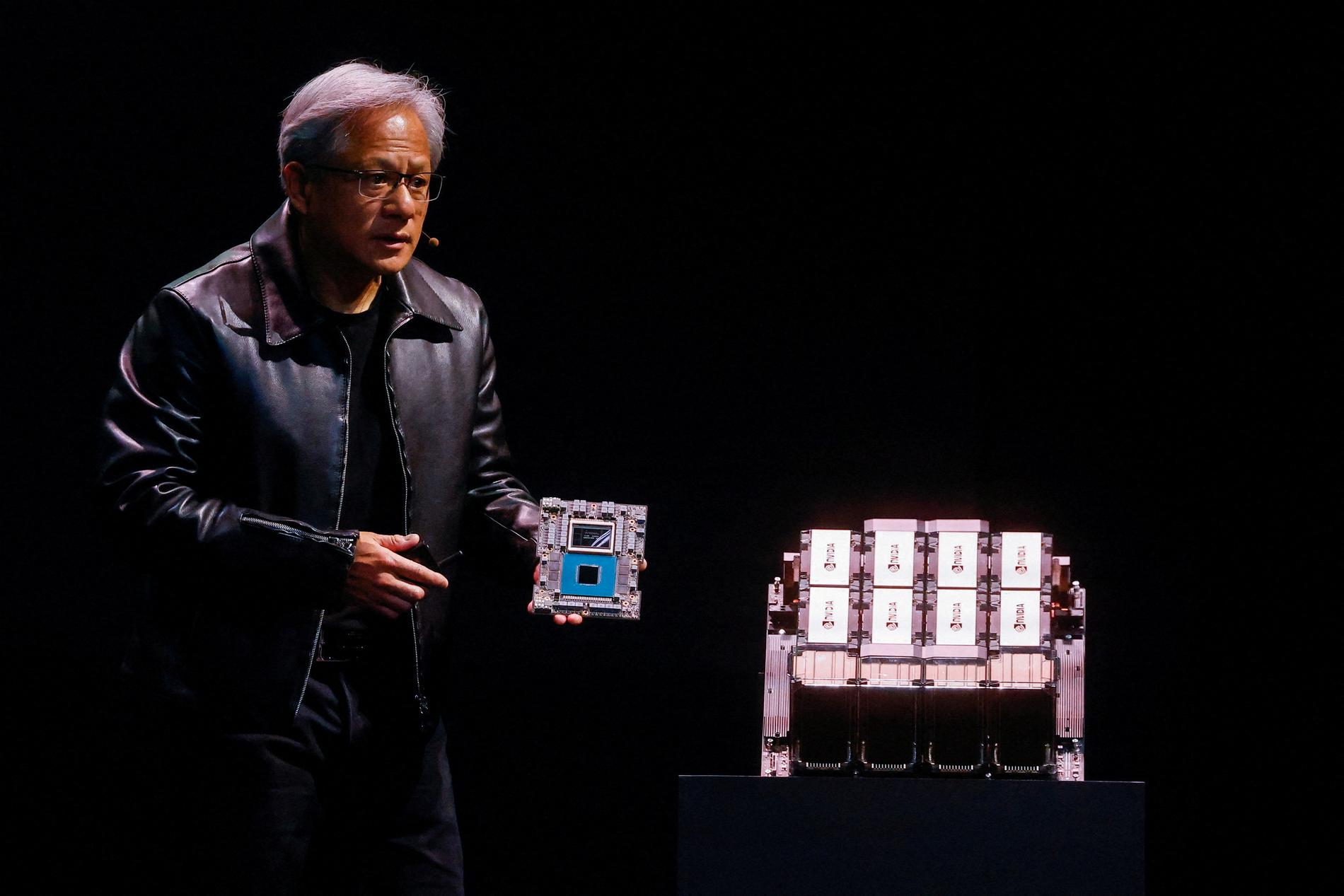

American company Nvidia manufactures computer chips used in computers, cars, and robotics. The company is one of the largest in America when it comes to market capitalization.

With the arrival of artificial intelligence, it has become important, among other things, because it is used for the devices that run chatbots. The introduction of ChatGPT contributed to a sharp increase in demand for Nvidia’s H100 chips.

Nvidia CEO Jensen Huang stated that the company is seeing an increasing demand for its products.

Read also

Chipmaker shares dumped – missed the price hike

said Michael Sansutera, chief investment officer at investment firm Silvane Capital Management Wall Street Journal regarding the hike As for Nvidia’s involvement, it’s only now, after several months of talking about AI, that the money is starting to flow.

– This will be the biggest technological change we have seen since the Internet, he told the newspaper.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”