There has been a complete tussle between billionaire John Frederiksen and manager Vegard Søraunet after cooperation at the Aeternum Capital fund completely deteriorated. But now the parties are ready to bury the hatchet.

According to the joint letter sent to DN, they have reached a solution in the form of a settlement that they believe will also benefit other investors in the fund. All investors have approved the agreement.

“The two parties have now agreed to a solution to the situation,” the letter stated.

As DN understands, the agreement essentially means that Frederiksen and his investment company WQZ Investments Group can withdraw their money from the fund much faster than the fund agreement actually stipulates, and waive part of the redemption fee, which would otherwise amount to NOK 25. million. At the same time, Soronette and his team – who Frederiksen was keen to vote in as trustees last week – will be able to continue managing the trust and the remaining funds.

The parties also agree to waive all claims against each other and to end all legal proceedings.

“Both the Manager and WQZ believe it is in the best interests of each other, the Fund and other investors, for the parties to separate from the Company,” the letter says.

Neither Soronni nor Frederiksen’s camp wanted to comment on the agreement on Saturday.

The long struggle

The conflict between Soroni and Frederiksen’s camp has been going on for a long time, but only became public knowledge when Frederiksen announced his exit from the fund forcefully a month ago – withdrawing most of the capital. It then culminated last week when Frederiksen called a general meeting of the fund, which is organized as a separate company, and thanks to an overwhelming majority of about 75 percent, Soroni and his team were voted out.

In addition, Frederiksen was found to have reported to Okukrim about Søraunet, Aeternum Management and the former head of the management company. However, that review was dropped, DN wrote on Wednesday. The parties have also taken various legal steps, and negotiations are scheduled to take place in the Oslo District Court later this month.

Søraunet said after last week’s general meeting that the parties nevertheless continued to negotiate a settlement, and DN understands that there have been several proposals for agreements from Aeternum Management since then. But in a letter to minority investors earlier this week, seen by DN, Søraunet made no secret of the fact that there were difficult talks:

“WQZ responded to the administrator’s draft by making new and unreasonable demands, and the administrator realized that it was not appropriate to continue,” Søraunet wrote as recently as Tuesday.

In the end, things worked out, as an agreement of a krone a week was reached, which for Frederiksen was arguably a sign of reconciliation. It became known on Thursday that his tanker company, Frontline, is close to entering into an agreement to purchase a large part of the fleet of the competing company, Euronav, which will mean the end of the conflict between the two companies after the failure of a merger plan between them.

Bracing or not

The conflict relates to whether the fund used leverage or debt financing. Frederiksen’s camp accuses Søraunet of using it in a way that violated the fund agreement when Aeternum bought 20 percent of Swedish company Skistar in the fall of 2021. Frederiksen believes the managers imposed guarantees on the fund that posed a significant risk of loss, and called the move a “serious breach of trust.”

For its part, Søraunet confirmed that there had been no breach of the agreement, and that the relationship had in any case been rectified in a timely manner. Furthermore, he believes that the entire conflict was orchestrated by Frederiksen because the billionaire was not satisfied with the return and fees, and wanted to exit the investment as quickly as possible. He told DN that Frederiksen wants his “head and reputation as a manager on a silver platter”.

Aeternum started out very well with a 58 percent return in 2021, but fell to -38 percent last year. In the first half of this year, the fund rose by ten percent. In total, Frederiksen invested NOK 5.6 billion in the fund, with the family’s stated aim of distributing the significant wealth to things other than the core businesses of shipping, maritime and agriculture.

Frederiksen was the fund’s first and only investor for a long time, but since the fall of 2021, several Norwegian and Swedish investors have come in, mostly from family fortunes. Before the vote just over a week ago, many of them criticized Frederiksen’s behavior and urged the parties to reach a solution.

However, two small investors voted for Frederiksen, according to DN information, namely the family firm Sanden and Kjell Christian Ulrichsen and the family’s investment firm Vicama. All investors are offered redemptions on the same terms as WQZ, according to the announcement.

The agreement with Søraunet means that WQZ is entitled to redeem its share in the fund in the form of invested shares and cash. The withdrawal date is effective September 30, although in practice it will take a little longer. But by comparison, the plan was originally for a recovery process of at least a year and a half.

“After the distribution, the Fund and WQZ will be co-owners of several companies. The two parties agree to coordinate their joint ownership in these companies to the extent necessary,” the report said.(conditions)Copyright Dagens Næringsliv AS and/or our suppliers. We would like you to share our cases using links that lead directly to our pages. No copying or other use of all or part of the Content may be permitted except with written permission or as permitted by law. For more terms see here.

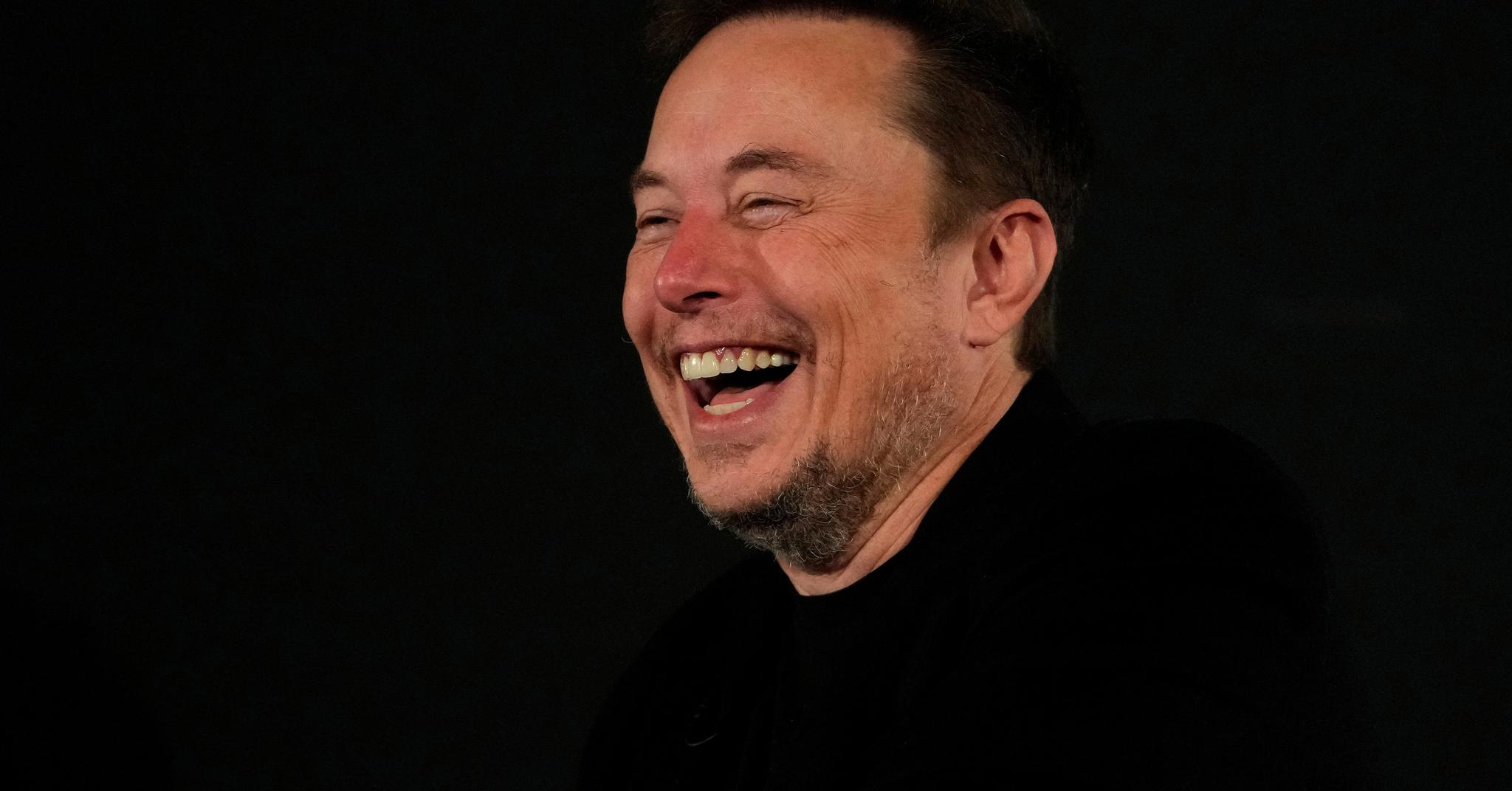

John Frederiksen, 75 years old: What do you give the man who has everything? (2019)

Most of the gifts for John Frederiksen’s 75th birthday were secret, but the shipping magnate finally revealed a gift.

02:36

Published:

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”