Robert Ness relies on a lot. Perhaps it’s no surprise that he saw it too The proposed basic rental tax in the seafood industry. As an industry owner, Nordea Fondene is directly affected by the proposed tax.

Nordea has investments in the industry, so we are affected as well. On the one hand, it is understandable that those affected are protesting vigorously. But I also understand the land rent tax, it has been very successful in the oil business, Ness tells Netavizen.

At the end of September, the Støre government proposed a land lease tax on aquaculture with effect from 1 January 2023. The government believes that it is reasonable for the community to receive a share of the exceptional return generated from the exploitation of these resources.

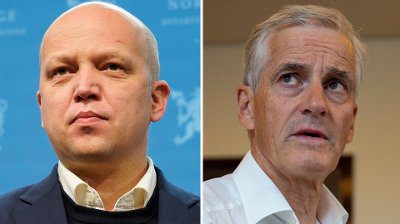

The proposal includes the production of salmon, trout and rainbow trout. This means that the base interest is taxed at an effective rate of 40 percent, but at a land discount of 4,000 to 5,000 tons. In addition, there is the regular corporate tax of 22 percent, for a total of 62 percent. Finance Minister Trygve Slagsvold Vedum is now open for changes.

Read also

The cruel confrontation with Støre and Vedum: – frankly terrifying

– Clever but poorly designed

– Since Norway has a topography which means production will stay here, it is smart, but perhaps not sympathetic, to tax the sector additionally, says Ness.

– But what bothers me is that it is a poorly designed tax. It’s unfair, it creates many cascading effects, and it’s not powerful. So, if you consider the “quality” of the tax, then this is considered a failure.

Næss is concerned that there are five basic standards of good tax in textbooks on tax policy. It should be efficient (low distortion), easy to manage, flexible, easy to understand and just.

He claims that the new tax does not meet any of the criteria.

Read also

Vedum curbs inflation on lobsters, Prada bags and Ferraris

sell away

– A company that produces less than 4000-5000 tons is exempt from the land rent tax. Over time, this will result in larger companies selling parts of their operations to smaller, independent companies.

This will save a lot of work for tax attorneys and auditors, and will also mean that the industry is moving from large, efficient companies into a jungle of small businesses, warns Nordea’s investment manager.

Minister of State Erlind Trygve Grimstad (Sp) at the Finance Ministry told Nettavisen that the minimum discount could provide incentives to set up more companies in order to get more floor discounts. In order to counter adjustments through segmentation, only one lower deduction at the group level has been proposed in the counseling document.

Read also

FRP leaders are being slaughtered for owning salmon stocks: – Sell the stock or close it

without purpose

Then there would be no purpose for dividing the largest companies into smaller units. Rules are also set at the owner’s level, so that businesses owned by the same person and their relatives only get one base deduction.

At the same time, we hope that this will avoid the opposite: that large companies buy into small companies, so that we end up with few, at worst, foreign owners in the Norwegian agricultural industry.

For medium-sized companies, it would be easy to break up the company into several independent companies, and Næss believes this can happen quickly. For the largest companies, this will likely be a longer process that will take place over time.

The base interest tax is based on the market price of the salmon.

This means that it is risky for companies to sell with longer contracts. A large portion of sales today go to large international retail chains that usually want fixed prices. Ness says this will be difficult going forward and gives the market a “headache”.

More than 100% tax

It is an example with a company that sells long contracts at 75 cones per kilo and costs NOK 50. Then they earn 25 NOK per kilogram before tax.

– But if the short-term rate is NOK 100 per kilo, they must pay a 62 percent tax on the theoretical profit of NOK 50 (100-50, editor’s note). That’s 31 NOK and more than the company earns. This means that the tax rate will be more than 100 percent.

– How did Nordea’s chests adapt after the proposal?

– On our part, we made minor adjustments. We bought more in companies that would benefit from the tax offer and reduced in others.

According to Næss, there is an upside for investors if the final proposal will have a slightly lower tax rate. On the other hand, the above example with spot prices in the tax calculation can damage the industry.

– In addition, the sector is likely to be “damaged”. In the coming years, there will be a lot of talk about taxes, adjustments and the apparent decline in profits after taxes. This is not the best criteria for a stock increase.

Read also

Major investment decline in northern Norway after tax shock: – Huge shock

Big internal differences

According to Næss, for large companies, which themselves produce and own wellboats, there will be a number of issues with transfer pricing: how internal billing should be done in companies, and what rates and rates should be used as a basis tool.

Part of the business pays 22% tax, while other parts pay 62% tax. It is then clear that companies will use a lot of resources to reduce profitability in the high tax area. For the tax authorities, it will be a difficult task to analyze the correct distribution, Ness predicts.

The tax depends on the total production. There are a number of things the seafood company is doing today that are unaffected. So Ness believes the proposed tax violates the principles that it should be simple and fair.

It is complicated to know how the tax affects individual companies.

Read also: The stock market crash of salmon billionaires: Witzøe jr. Saves 76 million in wealth tax

You can earn 100 million

A player producing less than 5,000 tons is therefore exempted from the land rent tax. With salmon prices of NOK 80 per kilogram, its turnover is NOK 400 million. These companies can earn up to NOK 100 million annually after taxes.

– All listed companies will be affected, but most of the owners here are small investors. This means that the smallest investors in effect also have to pay the land rent tax, while only a select group is exempt, says the investment manager.

– What will happen next?

– If the tax does not change, all companies that produce something over 5,000 tons will split the companies. Bear and Christine each own half of a company that produces 9,000 tons, it’s just a matter of creating two companies.

If Bear and Kristen were married or a father and daughter, it wouldn’t help to split the company in two. But the tax will be 62 percent on the part of the company that exceeds 4000-5000 tons

– After that, a new buyer outside the industry will earn twice what Bear and Kristen earn after tax. So Per and Kristin will likely sell half of the company on the open market. Thus, the company will be broken up, and the state will not receive the base interest tax, says Ness.

many transactions

For Mowi and other large agricultural companies, he says, it is not out of the question to sell parts of the production process to others who avoid the land rent tax.

– There will be a number of transactions so they are not likely to get away completely. Smaller businesses get cheaper licenses, and the number of businesses that have to pay land rent tax is significantly reduced.

Ness understands what’s clearly wrong: the high clearance limit.

It is tempting to think that the reason for this is that politicians want to take care of their good local supporters, and even beat up a few of the rich.

– But it does work in practice. They allegedly create a tax that affects a few and results in significant adjustment costs.

a fraud

Ness believes the cap may be a “trick” for the law to pass, and then the amount is gradually reduced over time.

– But in this case it is fraudulent.

Seafood companies must pay for the licenses. On a franchise tour just two weeks ago, Ness saw clear traces of this pattern.

– But we’ve also seen that prices have fallen dramatically. This actually means that the country is getting less income from seafood than before.

So to sum up, what do you say next?

That this means a significant increase in the workload of tax attorneys and auditors as a result of the division of companies. Businesses must spend significantly more resources on transfer pricing, and the IRS must spend more resources on corporate monitoring.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”