Electric vehicle batteries with LFP (lithium iron phosphate) cathode chemistry are expected to become more and more popular in the coming years. The last manufacturer to confirm that they are looking into the material is Mercedes-Benz.

They will use LFP cells in the batteries of their cheapest electric cars from 2024, Writes Bloomberg.

The next generation of EQA and EQB will be launched in 2024 and 2025. These will contain LFP batteries, says Mercedes CEO Ola Källenius in an interview with the newspaper. He thinks customers will be willing to sacrifice some scale to get cheaper electric cars.

Unlike other common cathode materials, LFP is nickel and cobalt free. Raw materials have volatile prices, while iron and phosphates have a generally low and stable price. The disadvantage of LFP is that the energy density is lower than other common cathode materials. This is how one gets Less energy per kilogram of battery.

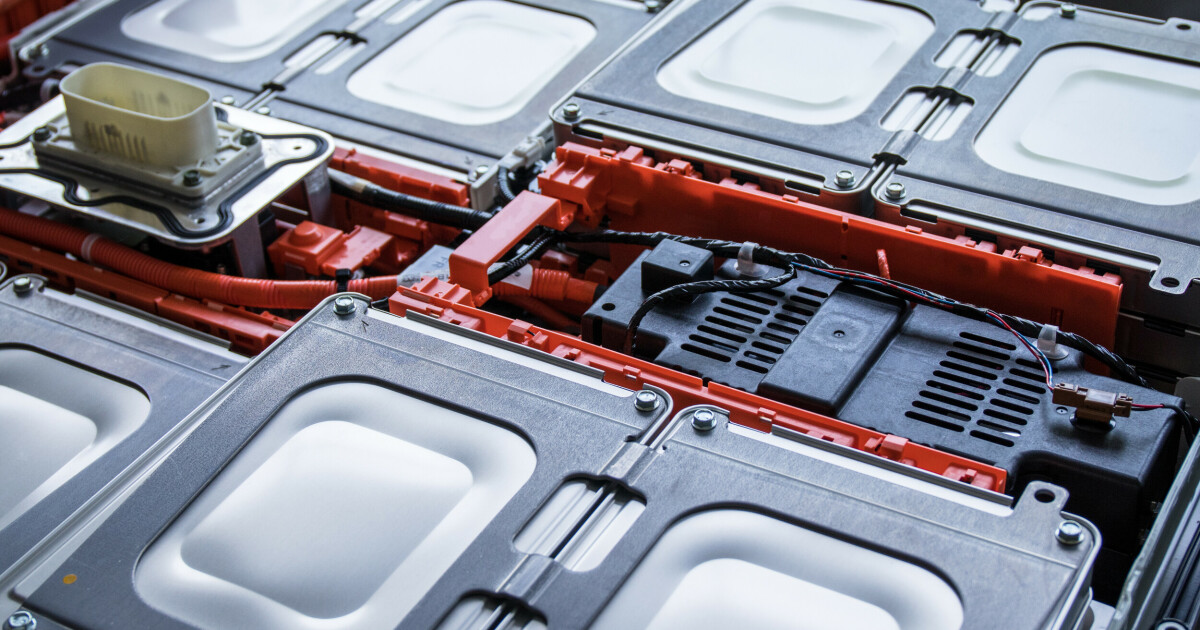

There are ways to reduce variation, especially the cell-to-pack technology which in short involves the use of cells in the battery as structural elements. It offers lower dead weight battery packs, and uses it, among other things, by BYD in its Blade battery, and in the Tesla Model 3 Standard Range battery supplied by battery manufacturer CATL.

Same LFP provider as Tesla

Mercedes currently buys nickel-rich batteries from CATL, which are used in the flagship EQS. The agreement between the two also means that Mercedes will use CATL’s LFP cells in the future, and make batteries using CATL’s cell-to-pack technology.

Källenius says he envisions many of their urban customers do not need large, agile cars, and that LFP-based electric vehicles will be a key technology to appeal to this group.

In addition to Tesla, which already supplies cars with LFP batteries, Volkswagen has confirmed that it plans to use such batteries in future cars. Like Mercedes, they will use this in their cheapest electric cars.

LFP batteries have been popular in Chinese electric cars for many years. One reason for this is the agreements that Chinese battery manufacturers have with technology patent holders. They have been able to build batteries in China to use in cars for the Chinese market without paying licenses. Thus, the Chinese battery industry has built expertise on this technology. The patents will start to expire from next year, which will allow export and production outside China to a greater extent.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”