In the 2023 budget, annual changes to municipal fees and property tax were adopted as normal.

Many of these services are self-financing, meaning that the municipality cannot make a profit on the services, but where the fee income must cover the individual service expenses. It is something that is checked annually by Rogaland Revisjon IKS, the company that audits the municipality’s accounts.

property tax

Some real estate, such as commercial and recreational properties, receive only municipal appraisal. For housing, the municipality receives the calculated market value (dwelling value) from the Tax Authority for real estate containing this value. The value of the property is determined on the basis of the price per square meter calculated by Statistics Norway (SSB) multiplied by the area of the property (parking room).

Egersund municipality receives the foundation automatically from the Swedish Tax Agency. Please note that the information the municipality receives from the tax authority is from the tax year two years ago. This means that for 2023 property tax, the municipality uses tax information from 2021 that comes from the individual homeowner’s 2021 tax return.

By March 1st, Egersund municipality will send a tax receipt (property tax decision) to taxable property owners. The tax receipt contains information about the property tax rate, the property tax base, the tax rate and the amount to be paid in property tax.

The Municipal Council has adopted the following tax rates:

- 3 per thousand in homes and vacation homes.

- 1 per thousand for undeveloped plots.

- 5.9 per thousand for all other properties.

Property tax 2023

Are you wondering why the value of the property changed in the property tax base for the property tax on your home from last year?

Regarding the submission of the property tax bill, we have received feedback from the property tax office that many homeowners have received an increase in their property tax for 2023. They state that the reason is that the Norwegian Tax Agency has increased the market value of many homes, which automatically leads to a tax increase property.

As mentioned in the previous section, the municipality uses the tax authority’s calculated market values as the basis for issuing the property tax, and the municipality has no influence on this value.

Municipality fees for water and sanitation 2023

These are municipal services that are self-financed, meaning that the municipality cannot make a profit on the services, but where the fee income must cover the individual service expenses. It is something that is checked annually by Rogaland Revisjon IKS, the company that audits the municipality’s accounts. These fees are officially known as fees, but are known to most people as municipal fees.

water charges.

From 01.01.2023, the water fee will be increased by 10% compared to 2022.

Exchange fee:

From 01.01.2023, the water fee will increase by 3% compared to 2022.

sweeping fees

Sweeping fees will continue at the same level as in 2022.

Renewal fees

As of 01.01.2023, the waste disposal fee will be set as follows:

- 3700 NOK for accommodation.

- NOK 2050 for cabins/holiday homes.

- NOK 2000 for emptying septic tanks (standard tank)

- All amounts are mentioned excluding VAT.

- Dalane Miljøverk AS sends an invoice for all amounts to Eigersund Municipality.

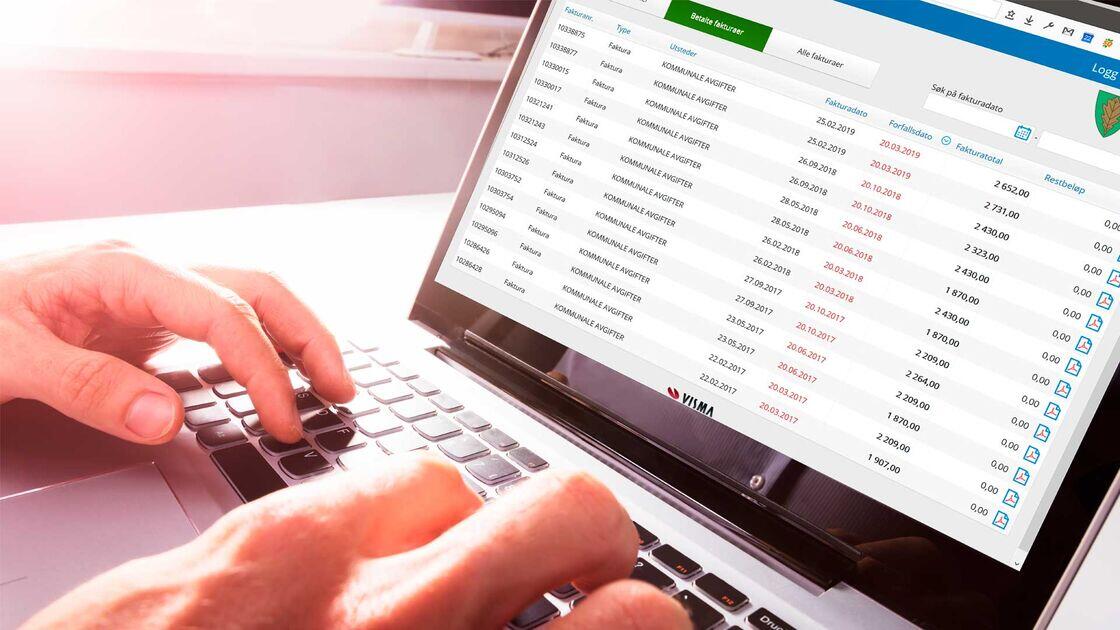

Municipal and property tax due date

For the year 2023, the municipality of Egersund will send invoices (invoices) for the comprehensive fee, property tax, water and sewage fee 3 times (i.e. in three instalments). For 2023, the due dates are as follows:

- First period for the period from 01.01 to 30.04, due on 20.03.2023

- 2nd period Period 01.05 – 31.08 Due 20.06.2023

- Third period for the period from 01.09 – 31.12, due on 20.10.2023

Change in municipal fees for the period 2017-2023

The table below shows the calculated change in municipal taxes, including projections for the coming year.

changes

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

2025

|

2026

|

|---|---|---|---|---|---|---|---|---|---|---|

water

|

-60%

|

–

|

–

|

+20%

|

+110%

|

+20%

|

+10%

|

+40%

|

6%

|

10%

|

Drainage

|

-40%

|

–

|

+70%

|

+10%

|

–

|

+10%

|

+3%

|

–

|

6%

|

5%

|

celebrate

|

–

|

+15%

|

+20%

|

–

|

–

|

–

|

–

|

–

|

30%

|

–

|

Do you need more information or assistance?

Then you can contact our guidance center on phone 51 46 80 00 or by e-mail to tugiartstorget@eigersund.kommune.no and they will be able to help you with more information or direct you to the right person.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”