Insurance company “scam hunters” are now testing new computer technology to catch more people.

- Insurance companies Gjensidige and Fremtind are testing new computer technology for fraud detection, and have reviewed 50,000 claim cases with the system.

- The system uses more than 100 parameters to detect manipulated photos and fake receipts.

- Younger people are behind a large number of fraud attempts, and company surveys show that younger people are more likely to commit insurance fraud.

- Insurance fraud is illegal and punishable, and attempted fraud can result in reporting, imprisonment, denial of insurance, and entry problems in some countries.

– It is a milestone in the fight against fraud. Gjensidige’s head of investigation, Vera Sønsthagen, says it’s important for our honest clients not to use their money to compensate fraudsters.

The Gjensidige test system uses more than 100 parameters to detect fake photos and receipts.

50,000 claims have been reviewed by the program.

– We do not give exact numbers for the number of fraud attempts detected, but several cases were detected among those we reviewed as part of the project.

And she adds:

My experience is that unfortunately we may be working with the tip of the iceberg. Dark numbers are relatively large, so where we look – there we find.

– Done well

What can the system detect that your trained eye can’t?

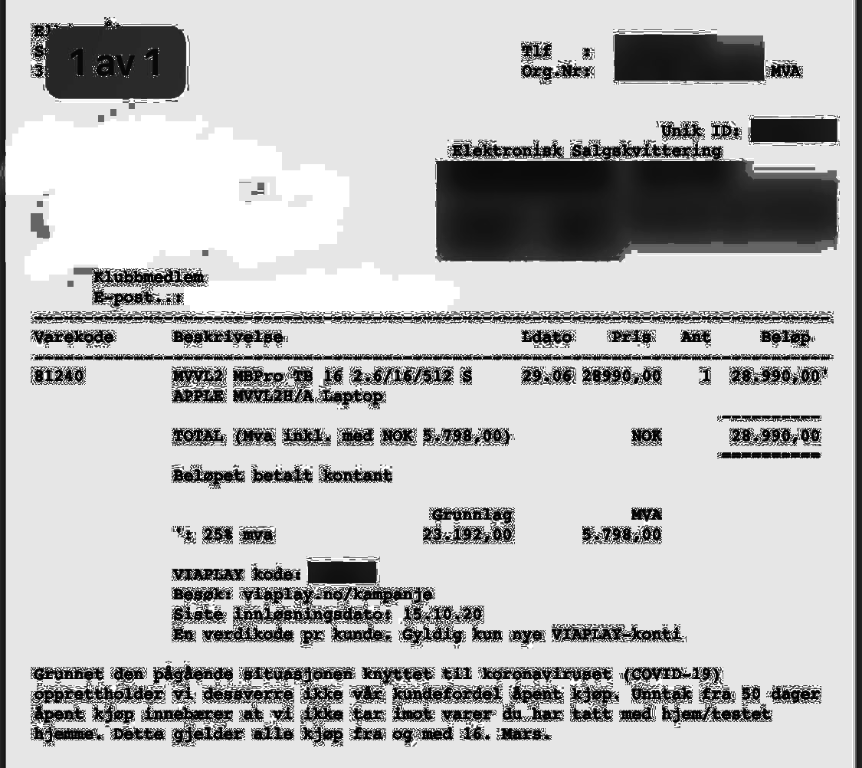

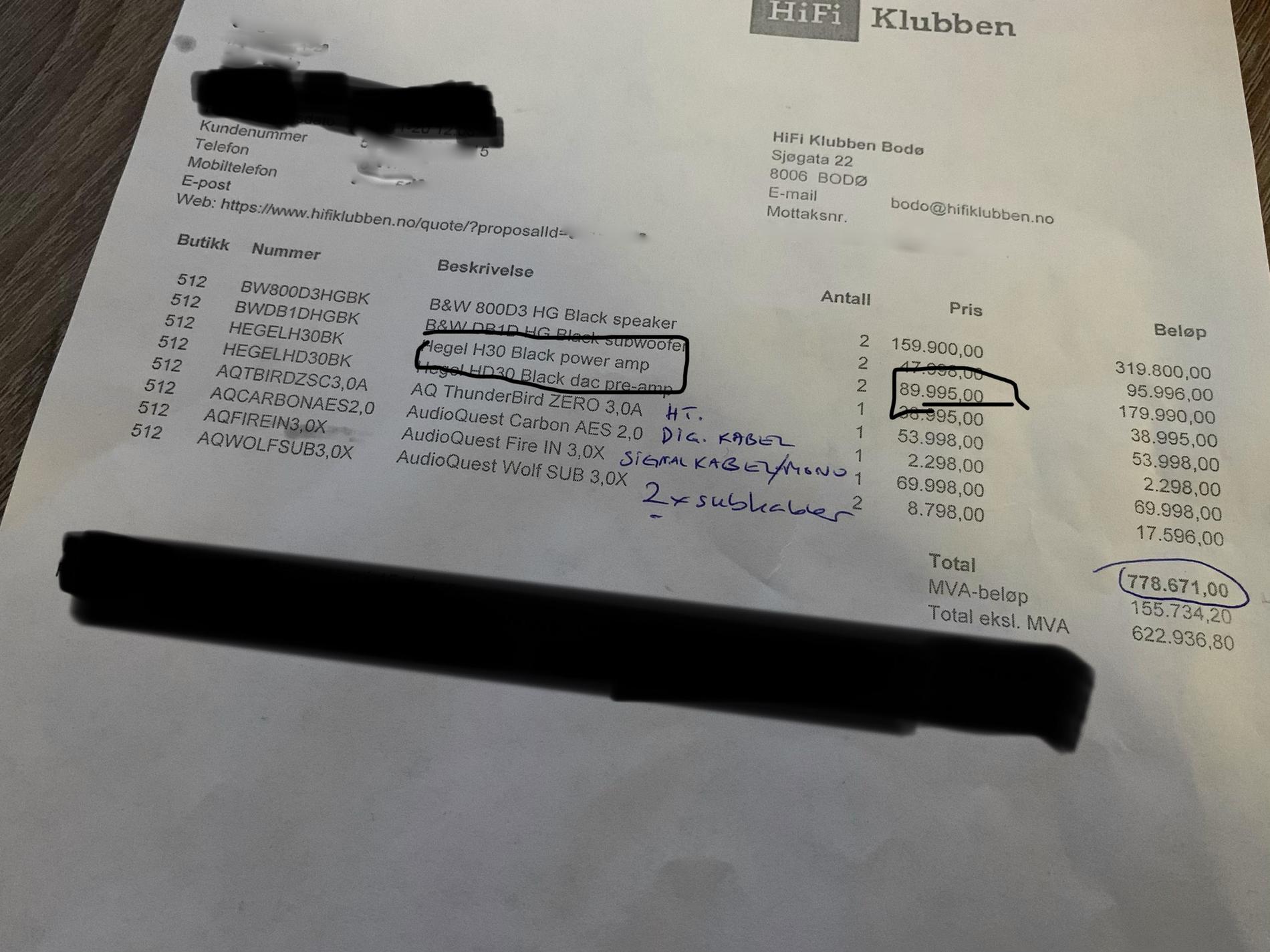

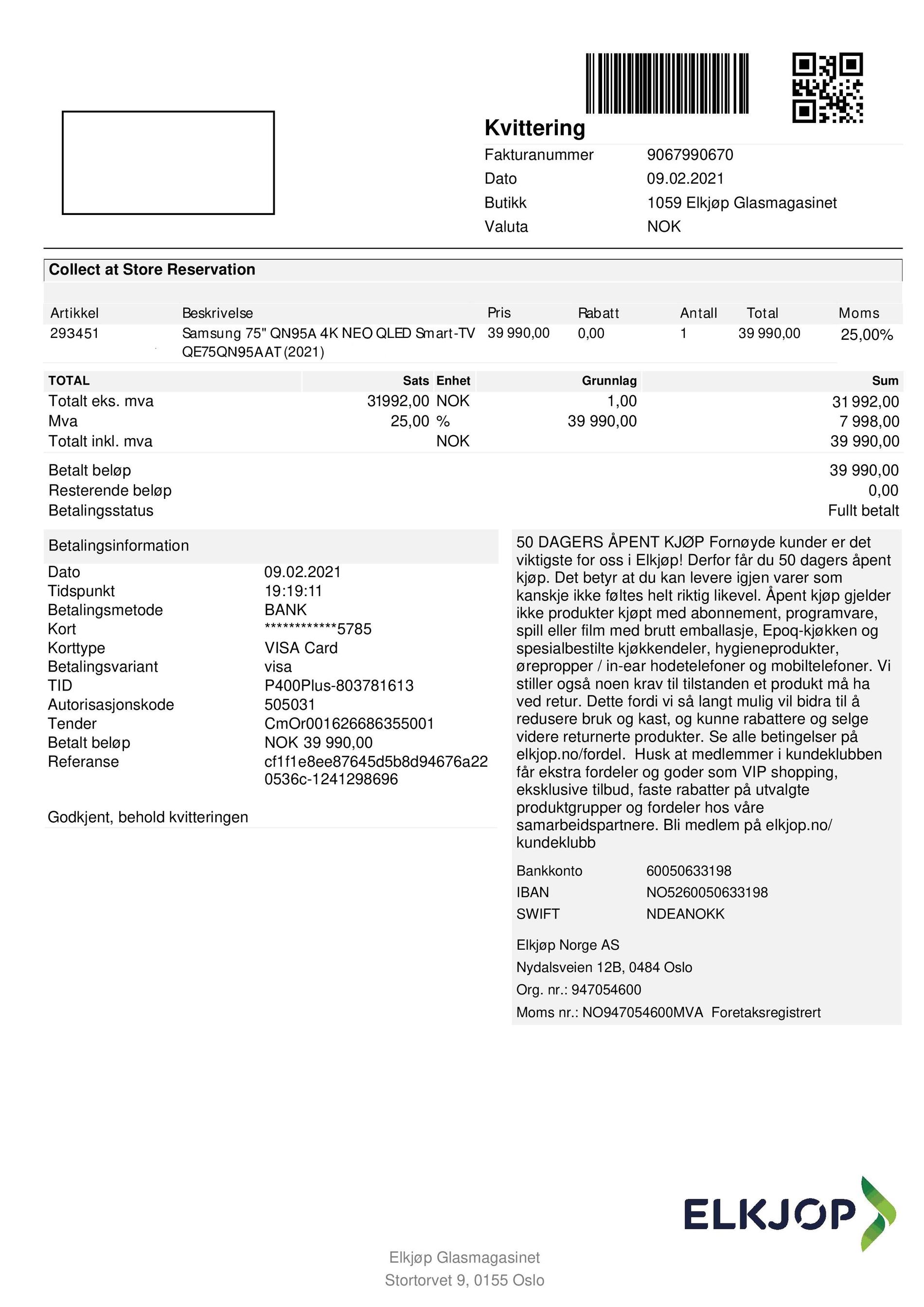

– Many fake receipts are very well made. Receipts from Power, Elkjøp and Louis Vuitton are among the most forged, says Vera Sønsthagen in Gjensidige.

She went on to say that manipulated images can be revealed if, for example, there is a shadow missing, which should have been there.

– The new software also checks background data for photos and documents.

Some scams are more professional and easier to spot.

– Sometimes we get attached pictures taken from the internet instead of our stuff. If the Bunad is reported stolen, we require a photo of the person holding the Bunad, not just a photo of a similar Bunad. There are also different applications and techniques that can make an object look damaged, says Sønsthagen.

– can code

Sønstehagen in Gjensidige says they see a large number of scam attempts from young people.

– A lot of people know how to code so it can be easy to fake it.

The former police investigator thinks it appropriate to be reminded of “morals and morals”.

– Insurance fraud is illegal and punishable, we report cases to the police. Those who try their hand at fraud risk a police report, jail time and denial of insurance. I don’t think all young people know how dangerous fraud is. Many people seem to think it’s not that serious because it’s so simple.

Fraud attempts can end up on a driver’s record and this can lead to entry problems in some countries, if the fraud is serious.

She says the company’s behavior survey, conducted over several years, shows that young people are more likely to commit insurance fraud.

numbers from Finance Norway Last year, the insurance industry detected 924 fraud attempts within non-life private insurance. About 200 of these were school and disability products.

The total amount was more than NOK 92 million for the Norwegian insurance industry. In 2022, the number of cases increased by 7 percent after a decline in 2021.

– A significant increase

Fremtind has also adopted new technology in looking for insurance fraudsters.

– This means that we will discover more and more fraud, reports Communications Manager Anette Grønby Rein.

The number of insurance frauds at the company rose 16 percent in 2022 from the previous year.

According to Grønby Rein, there is a particularly large increase in scammers under the age of 30.

– The number of fraud cases increased by 30 percent among young people from 2021 to 2022. Three out of four young fraudsters, our numbers show, says Gronby Rein.

Content insurance fraud is the most tempting for people.

– Fake invoices and receipts are used for personal gain. A popular method is to report claims that did not occur. A typical scam attempt is also to report that a person has been robbed, preferably from a mobile phone, PC or tablet.

Socially acceptable among young people

“Surveys show that insurance fraud is more socially acceptable among young people than other types of crime,” says Gronby Rein at Freemending.

They have no tolerance for fraud.

– Many people think that insurance fraud is not that serious, but fraud even for small amounts can lead to unconditional imprisonment. In addition, fraud makes it more expensive to insure other customers.

– What about AI technology that is now so advanced that it can create irreversible images?

– To date, we have not seen adequate AI-generated imagery as documentation of injury. Although it is easy to create images showing a broken object, it is relatively easy to notice that these differ from normal documentation. Our advantage is that we have a great basis for comparison and can easily see what stands out, says Gjensidige’s chief researcher, Vera Sønsthagen.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”