Tesla competitor BYD more than quintuple its after-tax earnings in the first quarter of this year. The result was 4.1 billion Chinese renminbi, just over NOK 6.3 billion. This corresponds to a growth of 411 percent over last year, according to the Financial Times.

The strong growth follows a very strong run last year, when the Warren Buffett-backed electric car maker increased its annual profit by more than 400 percent from a year earlier. The result in the first quarter was better than market expectations, according to the paper.

Bigger than Tesla and Volkswagen

Data from Shanghai-based consulting firm Automobility shows that BYD now has nearly 40 percent market share in the Chinese electric vehicle market, following sales growth of nearly 80 percent from the first quarter of 2022. BYD also has 17 percent of the Chinese market. for electric vehicle batteries and 62 percent of the plug-in hybrid vehicle market.

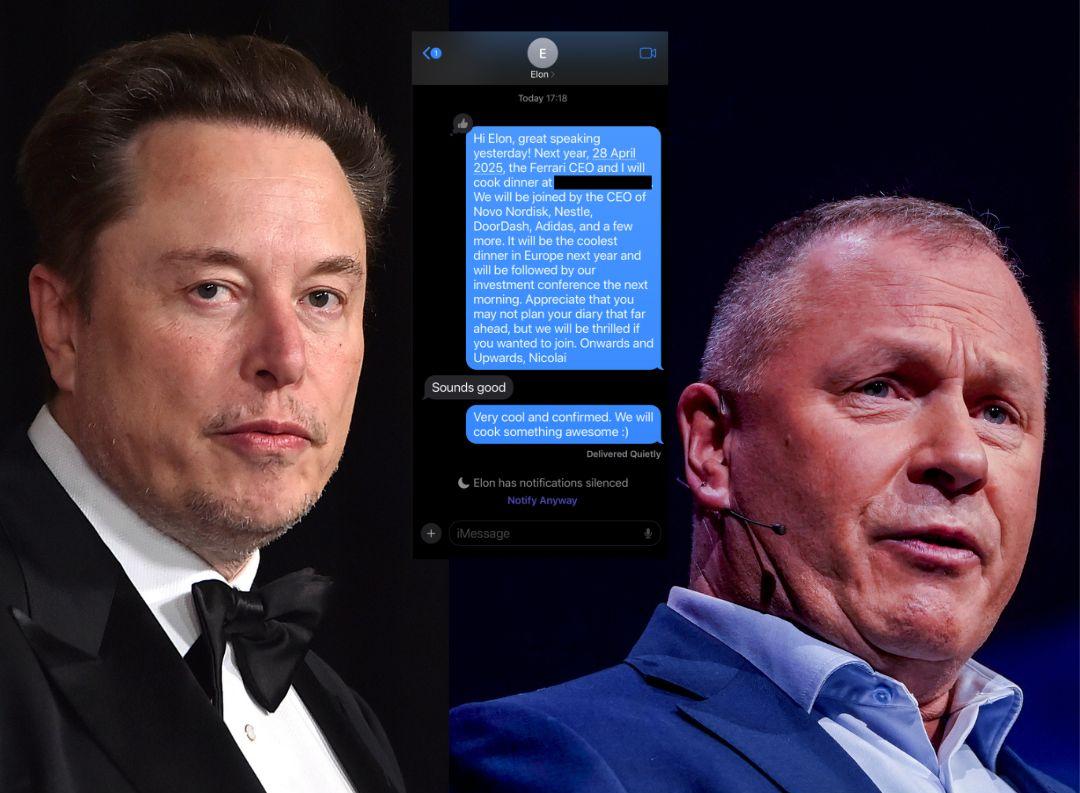

Tesla is the second largest player in the electric vehicle market in China with about 11 percent. Elon Musk’s electric car maker posted sales growth of 27 percent in the past year.

Germany’s Volkswagen is the ninth largest player in electric vehicles in China with a market share of 2 percent. This includes the auto giant’s Chinese joint ventures, according to the Financial Times.

Almost doubled in Q1

In 2022, BYD sold a total of 1.86 million vehicles globally – more than the previous four years combined.

In the first quarter of this year, the electric vehicle manufacturer achieved a 90% sales growth to reach 552,076 electric vehicles.

By comparison, Tesla sold 440,000 vehicles globally in the first quarter of this year — and 1.31 million vehicles in 2022.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”