Chess education company Play Magnus is listed as creditors to bankrupt cryptocurrency exchange FTX, but doubts they will get anything from the estate.

The fight for the remains after the FTX collapse is a big one: The creditor list contains 116 pages with the names of the various creditors they believe the cryptocurrency exchange owes them money.

Also featured here are two Norwegian companies; Run Magnus and Dune Analytics.

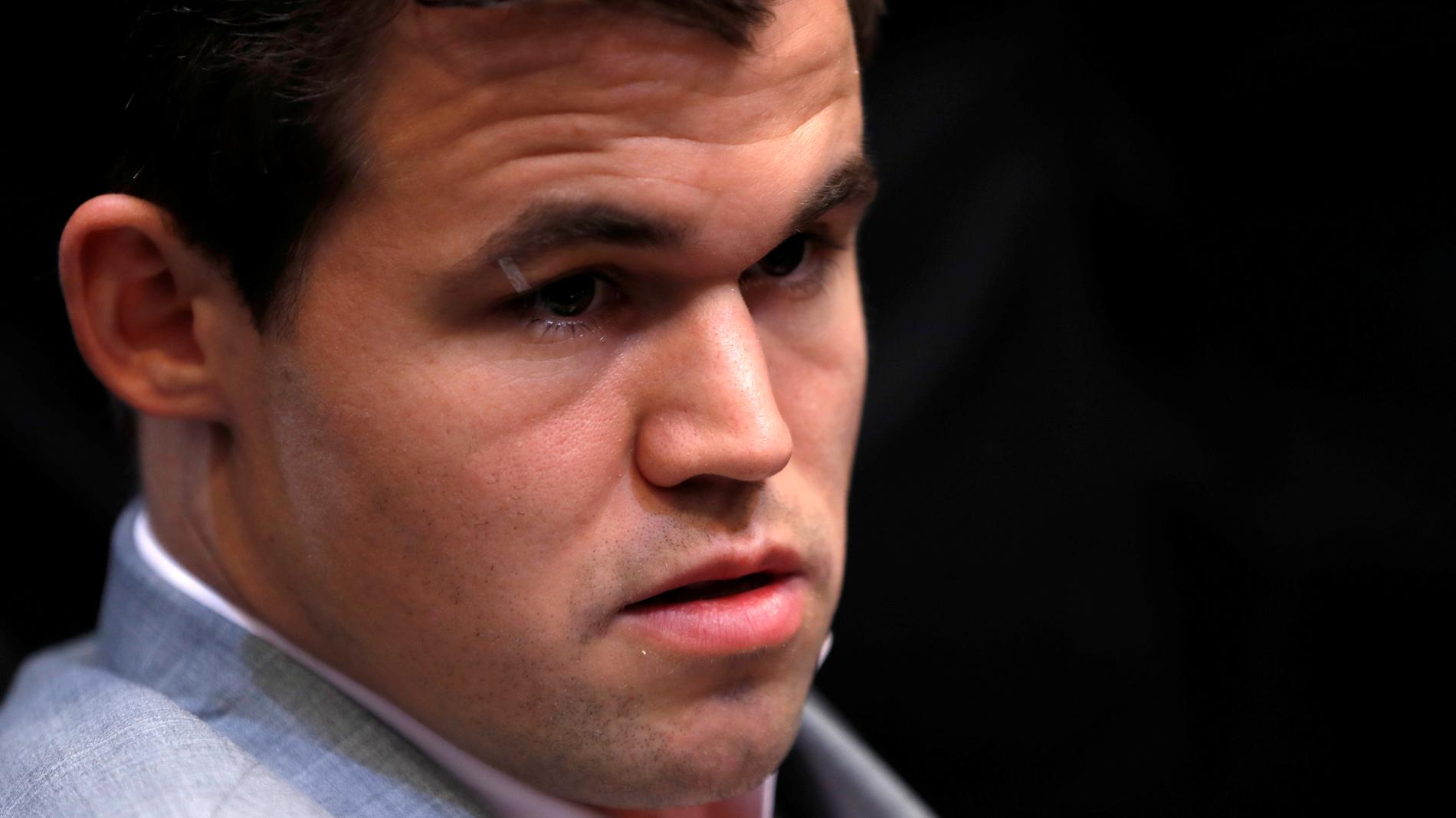

The first is the company in which Magnus Carlsen until recently owned a large stake. Play Magnus reported to E24 that they saw the claim against FTX as an opportunity they could take advantage of, but that they do not expect any money from the estate.

Magnus Carlsen was among the largest shareholders in Play Magnus before selling the entire company before Christmas to a subsidiary of Chess.com. Carlsen is now an ambassador for the chess program.

– remains to be seen

Crypto exchange FTX has been a sponsor of the Carlsen tournament for two years. The FTX Crypto Cup was a separate tournament on Carlsen’s Meltwater Chess Champions Tour.

In early November, a cryptocurrency exchange collapsed and filed for bankruptcy protection in the United States. The CEO, Sam Bankman-Fried, was the month after he was arrested in the Bahamas, accused of, among other things, fraud and money laundering that may have cost investors, customers and lenders several billion dollars.

Play Magnus now appears in the list of companies that FTX owes money to.

Play Magnus managing director Andreas Thome told E24 that the claim relates to the sponsorship agreement it had with FTX.

– FTX was a sponsor of the Chess Champions Tour. Our agreement also applies to 2023. Like many other FTX-sponsored players, we’ve made a point of standing out. He says whether we will get approval for our demand remains unclear.

company flight director Arne Horvei says they felt they could easily uphold the claim along with the many thousands of other actors who have claims against FTX. No money is expected from the bankruptcy estate.

– How much money is involved?

– We’re not going forward with that.

– But isn’t that volume on which other processes depend?

Not at all, says Horvey.

He warns that the actual claim against FTX does not mean the world is playing Magnus.

In the third quarter, Play Magnus had 55,000 paying customers on its platform. At that time, the company had a turnover of $18.6 million, about 186 million kroner.

However, the company had a negative result for the year, with EBITDA minus six million dollars or NOK 60 million.

The Norwegian crypto company is also on the list

Norwegian creditors include the billion-dollar success Dune.

According to Managing Director Frederic Haga(31), the blockchain analytics company has achieved a valuation of $1 billion. same means capital.

Depends on what the company can achieve one day. Last year, it had a turnover of NOK 6.2 million and a loss of NOK 9.5 million.

Haga recently moved to Switzerland. He justified this step by saying that the tax burden has become too great to be able to build profitability in the startup.

– I had to choose: do I live in Norway or do I want this company to succeed? It’s not about not paying taxes. Haga added that it was about paying taxes on money I didn’t have financial times.

Haga also said that Dune is still in the start-up stage and is therefore characterized by losses accompanied by rapid growth, and the bulk of the values are reserved for the company.

E24 attempted to contact Frederick Haga, but did not respond to inquiries.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”