Organized criminals are good at exploiting turbulent times and following the news well, says NorSIS Managing Director Lars Henrik Gundersen.

It refers to the epidemic, when fake vaccination watches and mis-branded masks were sold.

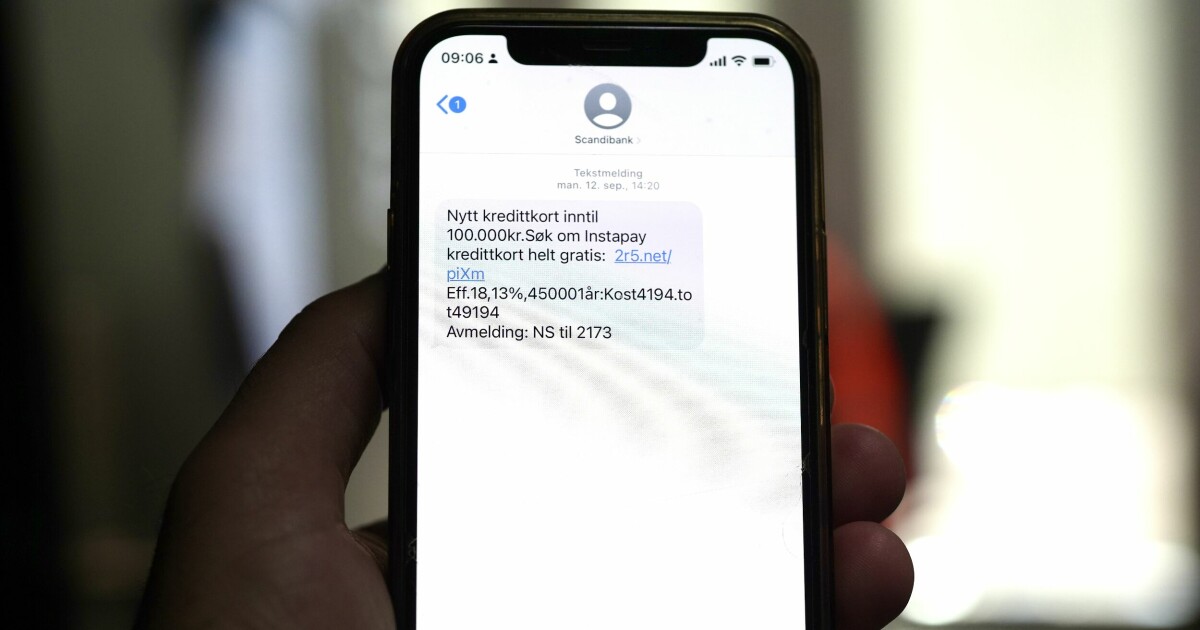

– This time with the fact that many people have tighter financial resources, perhaps they are easily inclined to good loan offers or afraid to receive push notifications.

Exploitation: The NorSIS CEO says that shortly after Queen Elizabeth’s death, criminals took advantage of it to defraud them for money. Photo: Norwegian Center for Information Security

This is how scammers advance

At the same time that people are experiencing tighter financial constraints, Gundersen says, banks are also more restrictive on mortgages.

– Then fake loan offers appear, or you receive a phone call from what you think is a bank that wants to get some information about your loan application, he says, and adds:

– When you say you have not applied for a loan, the story is that the bank can help stop the application, but then they need different sensitive information.

Gundersen explains that this information is then used to log into the online bank and empty the account.

Queen Elizabeth was taken advantage of

Last week, both the police and Krepos received inquiries from people receiving emails, some of them pretend they are.

Individuals: Norsis sees criminals increasingly targeting individuals. Photo: Mathias Kleiveland / TV 2

Although the police have been misused in fraud attempts recently, other methods are also being used.

Gundersen at NorSIS refers to a debt collection company whose name has been misused in a scam, in which people are contacted about a small amount owed.

Most people are concerned about receiving push notifications, at least if the economy is really tight, and are less critical than usual about transferring the small amount that scammers ask for.

In Agder, on Wednesday last week, the police reported an individual who received such a letter.

The person wanted to pay for himself and therefore followed the instructions. Soon, the account was A drain of several thousand kroner.

Another example that Gundersen points to is from Great Britain.

Shortly after Queen Elizabeth’s death, fake tickets were put up for sale to see the coffin on the show bed or to get to the front of the queue. There are no such tickets, and seeing the coffin is free for everyone, says Gundersen.

Increase: Thomas Iverson of the Consumer Council says many people are making contact regarding fraud. Photo: Halvor Pritzlaff Njerve / Consumer Council

One way significantly increases

The Consumer Council’s Guidance Service can report quite a few consumers who come in contact regarding fraud.

“We are seeing a steady increase in the number of consumers who contact us because they have ended up in frustrating fraud cases,” says Senior Legal Counsel Thomas Iverson at the Consumer Council.

The most they receive these days is finn.no scams.

– Here we have noticed a rather noticeable increase this year.

Finn.no fraud concerns consumers who buy relatively expensive things on finn.no, but Something completely different will be sent.

– social manipulation

NorSIS is also seeing an increase in phone calls, with the caller expressing themselves well in Norwegian and appearing to be very reliable.

Calls often come from a number that appears to belong to a bank or government agency, but is fake, says Gundersen.

Furthermore, we see criminals increasingly targeting individuals, with targeted fraud or social manipulation.

He explains that this is a result of companies gradually becoming better at data security, and better at educating their employees.

– If you get a phone call asking you for personal details, account numbers, bank ID, copy of ID or the like, hang up. No one will call you to ask about this.

If you provide sensitive information, Gundersen asks you to immediately contact the bank to block your cards and accounts.

It may be a good idea to activate a voluntary credit freeze in credit reporting agencies. It will then be difficult for unauthorized persons to obtain loans in your name. Always report fraud to the police.

Facts About “Plagiarism”

“Spoofing” means that the contact number that appears on the mobile phone is fake. The number that appears may be owned by the police, a bank, an insurance company, or a government agency.

The caller is abroad, usually in a large, professional call center, the so-called fraud factory. Most people have now learned that you have to be careful when answering calls from foreign numbers, and most people refrain from answering calls from hidden numbers.

Scammers know this, and so they use a technology that falsifies the displayed call number. For most people, it is completely incomprehensible that it is the police number that can be displayed when a fraudster calls from abroad.

Therefore, the scammers bypass the first barrier, the call is answered, and a form of trust has already been established. Thus the fraud that comes through “spoof” numbers is increasing exponentially in number.

Source: NorSIS

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”