After several days of gains, the three major indices on Wall Street opened lower on Thursday, but ended on a positive note. On Friday, there was a mixed mood on the New York Stock Exchange in the opening hours, and then things got tense for all three US stock indexes.

On the last trading day of the week, Wall Street looked like this at the close:

- The broad S&P 500 index fell 0.93 percent.

- The Dow Jones Industrial Average closed down 0.43 percent.

- The Nasdaq Technology Index fell 1.87%.

Wall Street rose sharply on Thursday. The S&P 500, Nasdaq and Dow Jones are up by an average of 1.0 percent, so US stock exchanges are up four out of the past five days. Nasdaq and technology shares led the way up, with Tesla, among others, up 9.8 percent on Thursday, after providing quarterly numbers after closing time on Wednesday. On Friday, Tesla stock rose 0.2 percent

More falls

Facebook’s Meta Platforms, Google’s Alphabet and other companies that sell online ads lost about $80 billion in combined market value Thursday after Snap posted weak quarterly results Thursday night and warned of an uncertain outlook Thursday night.

Snap shares collapsed with a drop of nearly 40 percent on Friday. At closing time on Wednesday, the stock was trading for $16 — after today’s sharp drop, the price was just under $10 a share.

Snap has been on a downward trend since last fall, a trend that intensified after Apple stepped in with a feature that would allow users to opt out of targeted ads. It reduces the amount of data apps like Snap can collect from their users and gives the company a significant reduction in advertising revenue.

Other social media stocks are joining Snap in a drag as investors fear a slowdown in online ad sales in the future. Google’s Meta Platforms, Alphabet, and Pinterest are down 7.59%, 5.63% and 13.54%, respectively, on Friday.

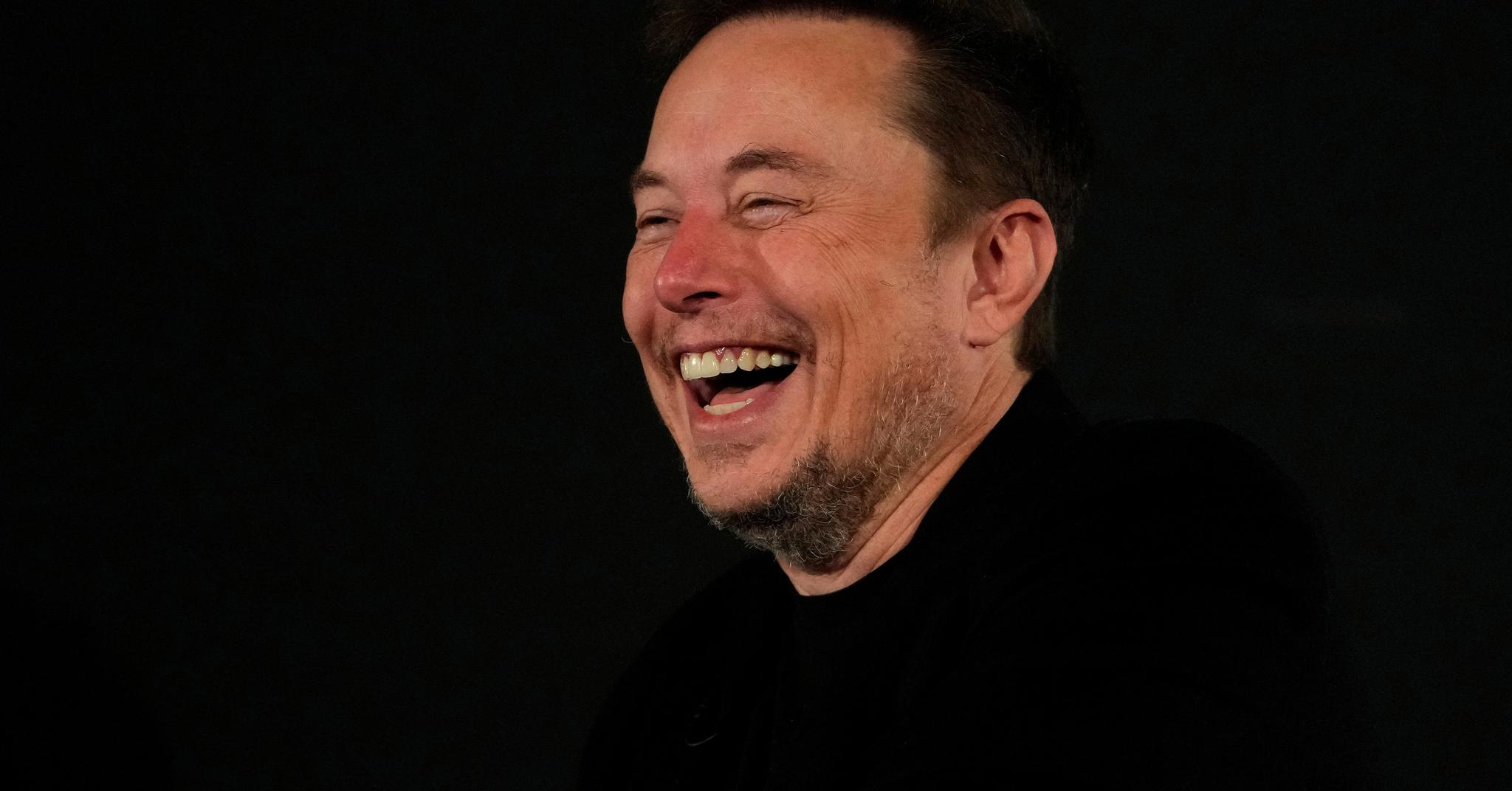

Before Wall Street opened on Friday, Twitter presented its numbers for the second quarter. The company’s decline in revenue is partly due to acquisition attempts by Elon Musk. Given the pending outcome of the Musk acquisition, Twitter will not provide an outlook for the company’s development in the third quarter. Twitter indicated that costs associated with the acquisition were approximately $33 million in the second quarter. Twitter rose 0.81 percent on Wall Street on Friday. (Conditions)Copyright Dagens Næringsliv AS and/or our suppliers. We would like you to share our cases using the links that lead directly to our pages. All or part of the Content may not be copied or otherwise used with written permission or as permitted by law. For additional terms look here.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”