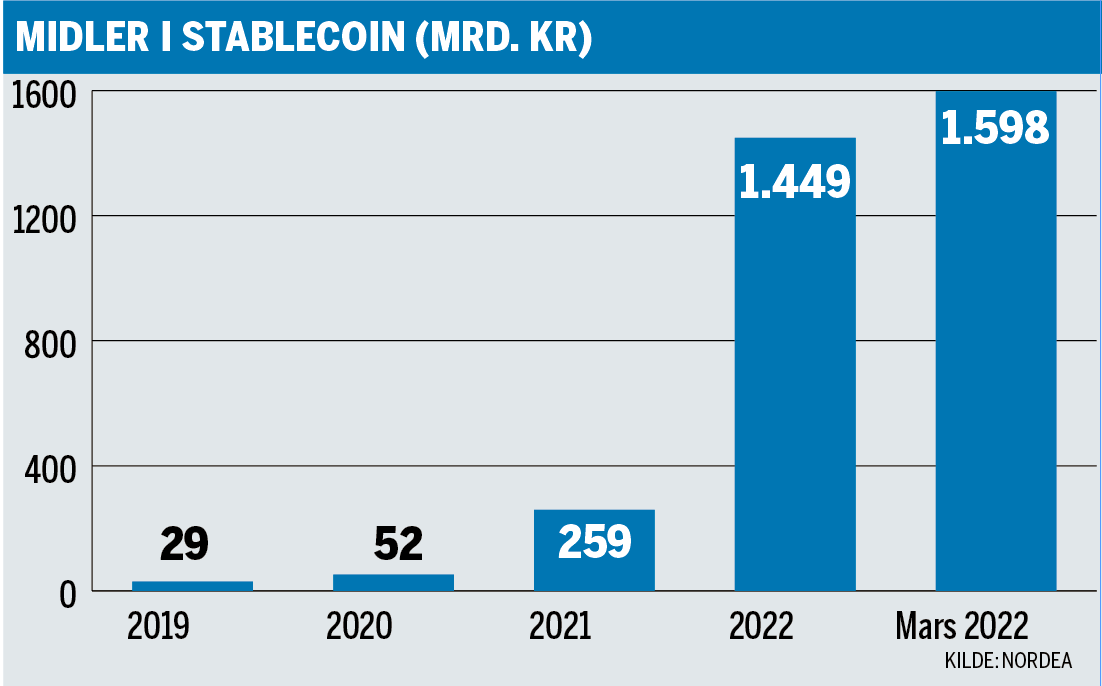

Some people use stablecoins to take breaks while trading regular cryptocurrencies since it is cheaper to exchange bitcoins for stablecoins than regular money. Much of the recent growth may be due to investors looking for an anonymous way to invest their money without being exposed to the massive volatility we see in Bitcoin. If you buy stabelcoins with another cryptocurrency, you do not have to identify yourself and then you can save on something similar to a normal bank deposit and at the same time avoid penalties and tax authorities.

Stablecoins are also used as a tool To process crypto investments. The companies that facilitate this need deposits and today get a double-digit interest rate for lending the stacked coins. Borrowers usually need security in the form of other cryptocurrencies such as Bitcoin. If the price of Bitcoin falls, one must sell some of the underlying currencies to maintain a margin of safety. It usually leads to an intensification of falls and this is probably one of the reasons why volatility in cryptocurrencies is so high.

Article author: Robert Ness, investment manager at Nordea Investment Management. Photo: Ivan Kvermi

On Thursday evening, it was announced that the Russian bank Sberbank had received permission to issue its own digital currency. The bank expects the process to move at lightning speed and expects the new currency to be ready before trading before we finish the Easter holiday. For Russia, which has been hit hard by the sanctions, this may give it a chance to get around the sanctions. In practice, Russians can then buy SberCoin for rubles and then exchange them for bitcoin or other cryptocurrencies. Thus, they are fully included in international payment systems.

High interest rates and anonymity can be tempting too much. However, there are two risk factors. First, there are a number of examples of coin penetration that could cause all or part of the value to be lost. The second risk is the collapse of security in the underlying crypto markets if someone lends coins at a nice interest rate. Even if the charts look safe, a high interest rate is a clear indication that risk is present.

Issuing a stack currency can be very profitable, and if a regulated bank enters the market, it will likely be able to capture significant market shares. The American company Circle recently entered the market and in a few years received 400 billion NOK in USDC, which is now the second largest coin in the stack. The company’s owners have so far earned more than NOK 50 billion on this investment.

The large increase in coins piled up means that more and more money is flowing out of areas where the authorities control and want regulation. In addition, there is a risk of collapse in the stacked coins in the event of a collapse of the underlying crypto markets.

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”