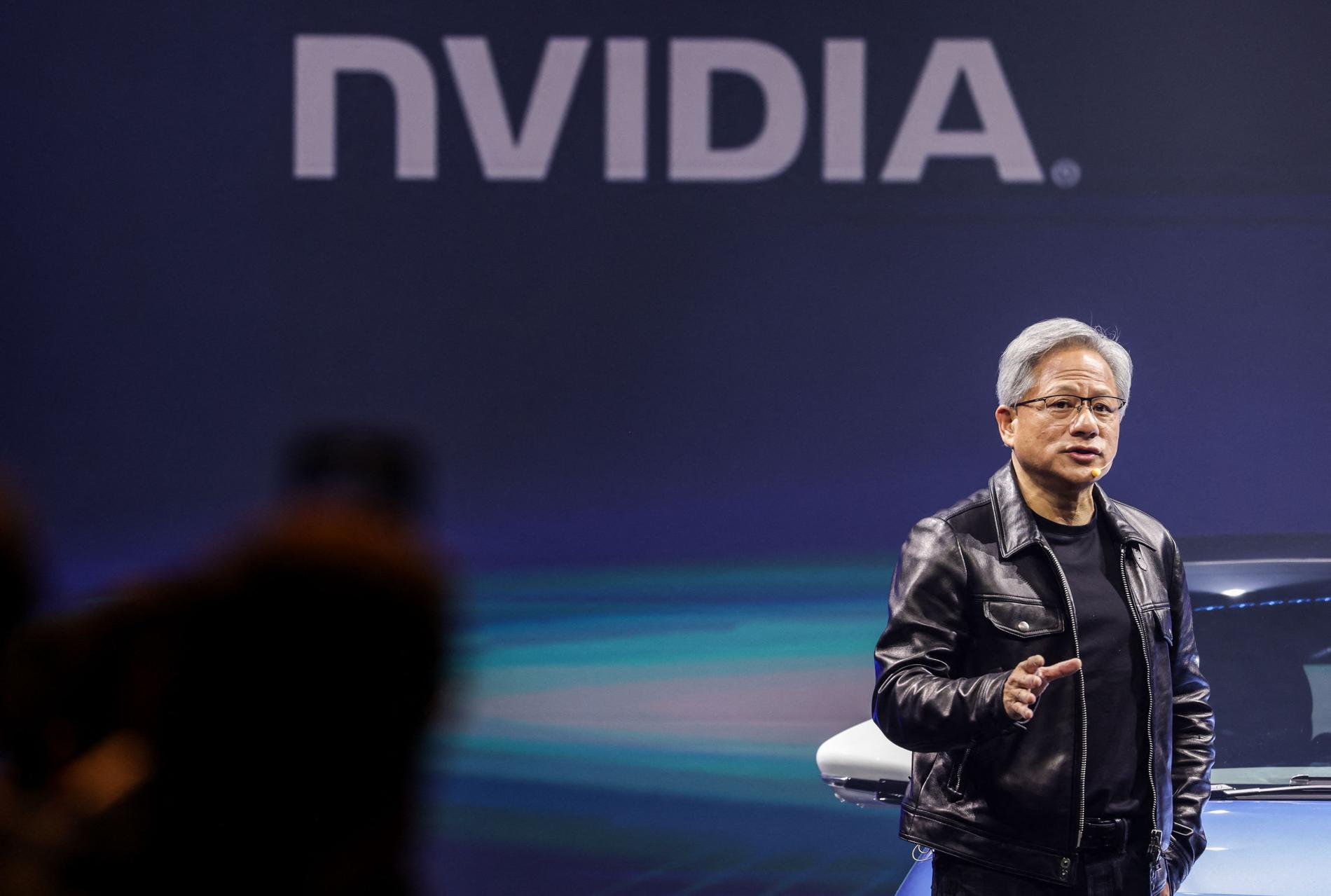

On Wednesday evening, artificial intelligence giant Nvidia presented new quarterly numbers. The investment manager says that after the intense expectations around artificial intelligence, the competition ahead is particularly interesting.

Shares of Nvidia, which produces computer chips needed by artificial intelligence companies, have risen on the stock market through 2023.

On Wednesday evening, the American company Nvidia will present the numbers for the accounting period that ended on January 28.

– There are not many companies in the world that are as profitable as Nvidia. It's unique, says Nordea's investment director Robert Ness.

Read on E24+

Who can we trust?

The company has benefited from the rise of artificial intelligence (AI). Næss calls Nvidia's business a state of the art, or The latest and greatest in the field.

The company on Wednesday is expected to report income of $20.4 billion in the quarter, up from $6.05 billion in the corresponding quarter a year earlier, according to Bloomberg estimates.

The biggest growth is expected to be in the data center business, which includes artificial intelligence. In this sector, revenues are expected to quadruple to US$17.2 billion.

– Demand is huge and the increase in profits is insanely good, says Ness.

– Nvidia shocks the market every three months. “They have to do it now too,” says the Nordea manager.

At the same time, it is impossible to have such growth “forever,” Ness explains, referring to basic economic theory.

Sky high market capitalization

Nvidia's share is up more than 230 percent in the past year, and more than 40 percent since the new year.

The share rose significantly as demand for the company's computer chips increased in line with the development of artificial intelligence. Data chips from Nvidia, for example the H100, are used by AI developers to develop models similar to those used by OpenAI to develop ChatGPT.

The rise in Nvidia shares has been parabolic, analysts at Bank of America wrote last week, according to The Verge. CNBC.

Last week, the company's market value rose to more than $1.8 trillion, placing it in third place among the most valuable companies in the world, surpassed only by Microsoft and Apple.

Thus, the computer chip manufacturer, which was founded in 1993, surpassed both Alphabet, which owns Google, and Amazon in the list. Both companies are relying on Nvidia chips to further develop their own ambitions around AI.

– The four companies (Apple, Meta, Amazon, and Alphabet) reported plans to increase their investments in AI this year, which bodes well for Nvidia's first-quarter guidance, Jill Loria, an analyst at DA Davidson, wrote in a note, according to CNBC.

– The competition is particularly interesting

Næss points out that Nvidia is in the driver's seat in AI development, producing components that other tech companies rely on to be leaders in the field.

Nvidia is among the world's leading manufacturers of graphics cards (GPUs).

– They started using the GPU for gaming originally, and because it can do many operations at the same time, it is also suitable for artificial intelligence, Ness says.

Ness believes that the picture will be different than it is today in three years.

Many are now experimenting with similar technology, including Google's Tension processing unit (TPU) designed specifically for artificial intelligence.

In addition, the stock of its main competitor Advanced Micro Devices (AMD) has risen sharply over the past year on news of new computer chips.

At midnight Norwegian time, the company is holding a presentation about the quarter. Then Næss hopes one can get an impression of what Nvidia thinks about the future.

– What Nvidia says about the future of the market will be very important. He says the competition is particularly interesting.

More highlights may also come during Nvidia's GTC conference next month. Among other things, Nvidia will likely say something about the company's next major AI system, called B100, which analysts expect will launch later this year.

Stocks fall on Tuesday

In releasing the numbers on Wednesday, investors will be more interested in the company's long-term prospects, he wrote The Wall Street Journal. Questions will also be asked about how long the AI boom will last, and how demand for AI chips will evolve over the course of the year.

On Tuesday evening, Nvidia stock fell 4.35 percent on Wall Street, in anticipation of whether the company can meet the high expectations set by the boom around artificial intelligence, he writes. Bloomberg.

Read on E24+

What comes after the technology euphoria?

Read on E24+

We stopped Elon Musk's giant stock package: – We caught them red-handed

Read on E24+

A new era in stock exchanges

“Web specialist. Lifelong zombie maven. Coffee ninja. Hipster-friendly analyst.”