Carl Icahn Enterprises and Icahn Enterprises are under investigation after Hindenburg Research took a short position against the company.

The blood of billionaires from past years was stained by the Hindenburg, when their report settled $100 billion from the enormous wealth of Indian Gautam Adani.

Now analytics firm Icahn Enterprises thinks it’s inflating its values.

Overall, we think Icahn, the legend on Wall Street, is making a classic mistake by taking on too much debt in the face of constant losses: a combination that rarely ends well, wrote Hindenburg in a report Tuesday.

Short stand and probe

Thus, the company took a short position, which means that you are betting against the company, which means that the value will decrease on the stock exchange.

Read also

Short sellers go after the ‘Wall Street legend’

Read also

The Oil Fund gets rid of Al-Adani shares

After the news, Icahn Enterprises crashed by more than 20 percent on the stock exchange.

Now the federal authorities in the United States have decided to take a closer look at the company’s accounts, write The Wall Street Journal. The company states this itself.

They further write in an investor update that he is cooperating with the investigation, and that they don’t think this will have a significant impact on the company.

The richest fields of Asia

The Hindenburg is the same company that caused the stock market crash of what was then Asia’s richest man, Gautam Adani, earlier this year.

Then the company also took a large short position. They believed that the Adani conglomerate was committing fraud.

Adani was at one point the third richest man in the world, with an estimated net worth of $150 billion. Now it’s down to 23rd place, with an estimated net worth of $53 billion, according to Bloomberg Billionaire Index.

He denied the accusation

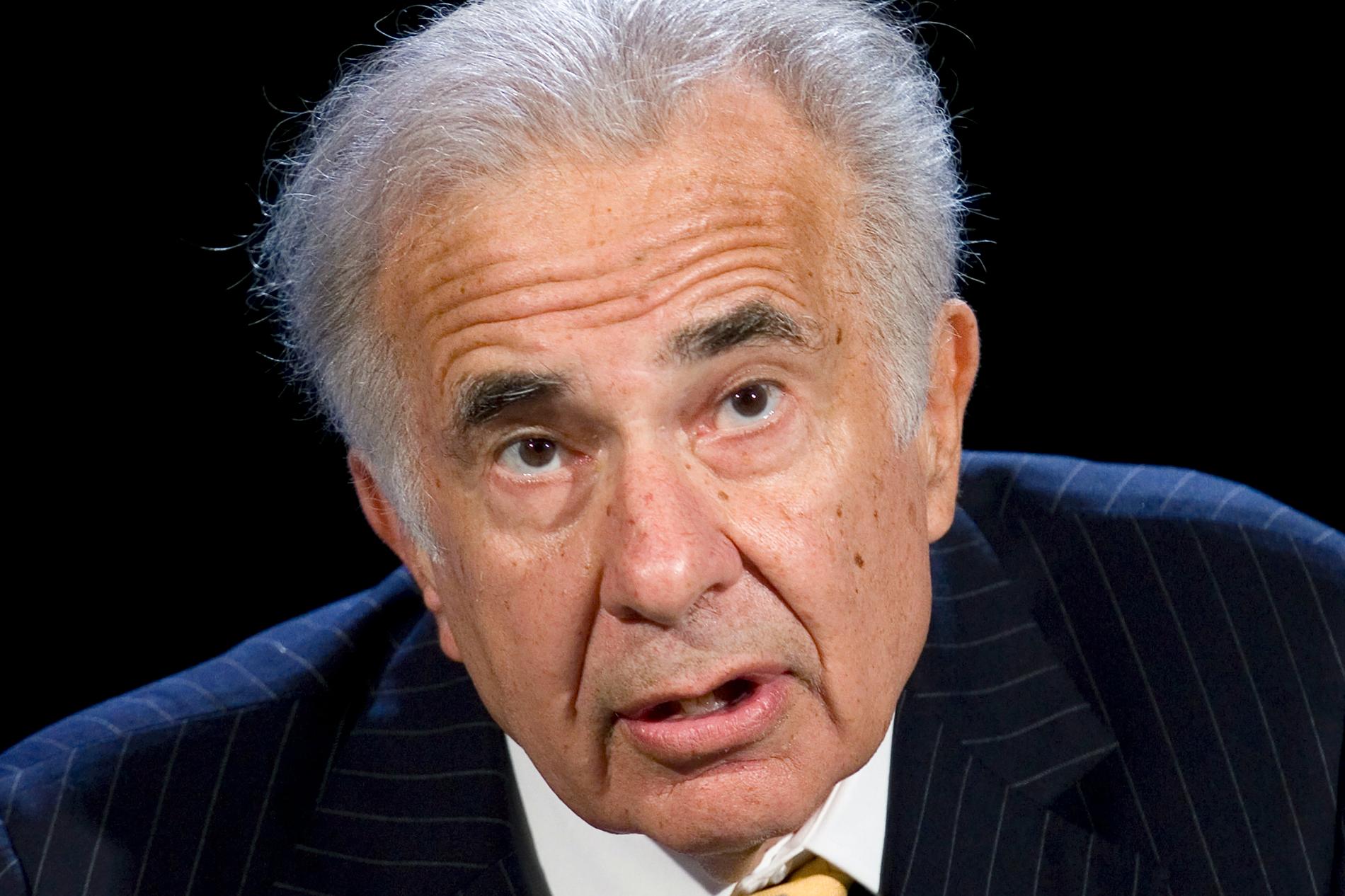

Carl Ichan, who is behind Ichan Enterprises (IEP), is known for being a very active owner in many of the companies he buys into. CNBC He writes that he became really famous after the hostile takeover of Trans World Airlines. Recently, he has been involved as an activist investor in McDonald’s.

When Hindenburg’s brief position became known, Icahn reacted harshly to the report.

“We believe that this selfish report by Hindenburg Research was only intended to profit Hindenburg’s short position at the expense of long-term IEP investors,” Icahn said.

He believes that Ichan Enterprises is responsible for the public information they have provided, and that its results will speak for themselves in the long run.

“Explorer. Unapologetic entrepreneur. Alcohol fanatic. Certified writer. Wannabe tv evangelist. Twitter fanatic. Student. Web scholar. Travel buff.”